On a common perspective, solar energy has long been viewed as an alternative power source, a clean yet capital-intensive shift that is more about sustainability than business viability. But those who have observed the numbers closely, especially in recent years, know that solar is not just an environmental necessity—it is an investment goldmine, attracting both policymakers and institutional investors at an unprecedented scale.

As a founder of Renewable Affairs and an industry professional since 2019, Aman Bhargava has been closely studying the trends, challenges, and market behavior in India’s solar sector. Based on his experience, here is what his analysis of the industry is.

The numbers, policies, and investor sentiment point to one undeniable fact—solar is set to become the next big economic driver, not just for India but for the entire world. The full potential of this transformation remains underexplored in the public discussion despite its rapid rise.

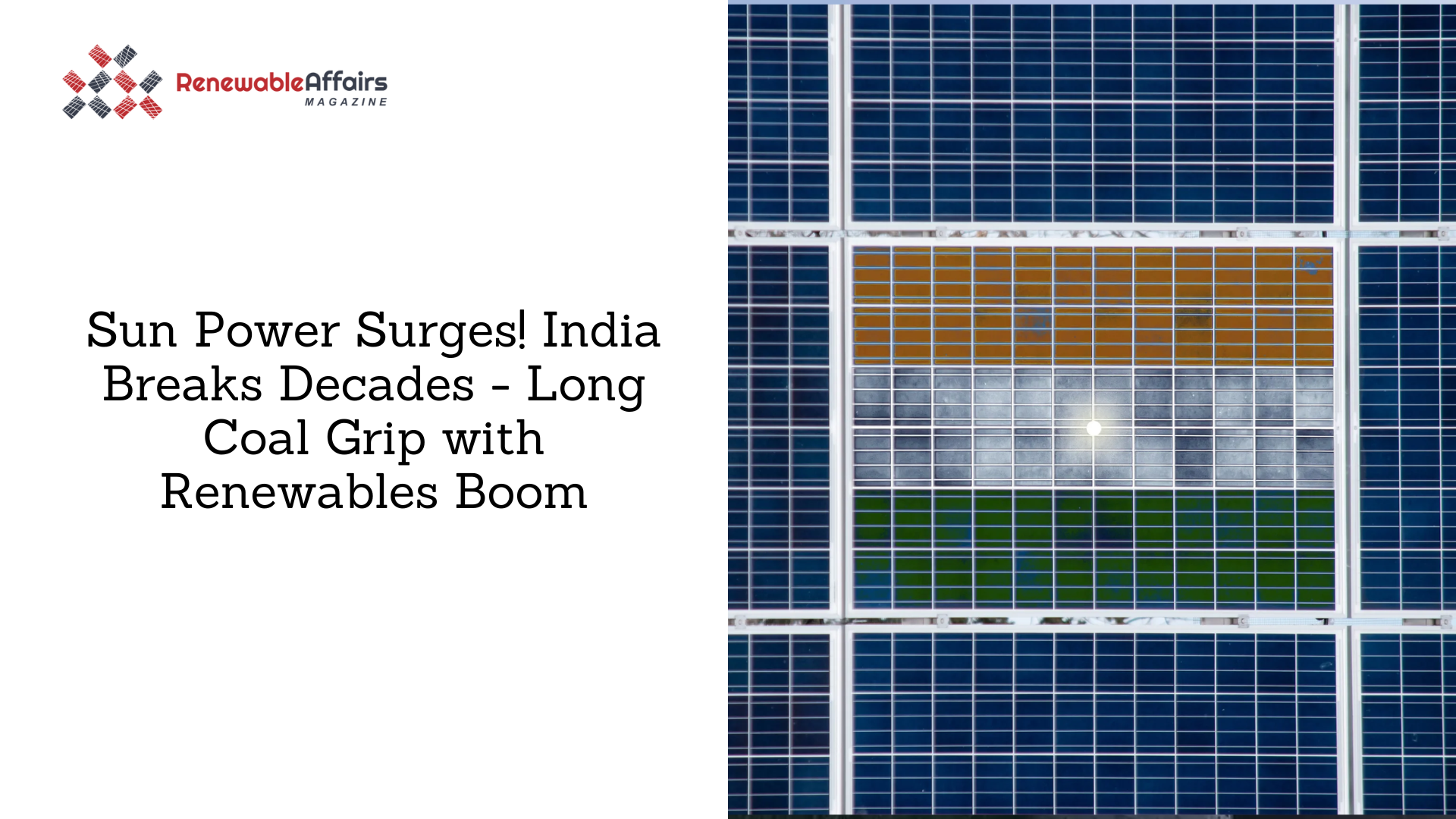

India is on the verge of becoming the third-largest economy globally, and energy independence will be a defining factor in this rise. With 300 sunny days a year, India is positioned to lead the solar revolution.

If we were to power the entire country with solar, we would need only 6,000 square kilometers of solar panels—a fraction of our vast landmass. Despite this advantage, solar adoption at the household level remains sluggish. Only 1% of Indian homes have installed solar panels, an evident contrast to Germany, where the residential solar adoption rate is 12.3% even though receiving significantly less sunlight.

However, this shift is happening faster than most realize. The first 100,000 homes in India switched to solar till 2019. By 2023, that number was being added every nine months. As of 2024, 50,000 homes per month are adopting solar, and this number is expected to double in the coming years.

The government’s ambitious Pradhan Mantri Surya Ghar Yojana aims to bring one crore (10 million) households under solar power in the next three years, with ₹78,000 in direct subsidy per household through a seamless digital process. This subsidy now reaches homeowners in less than 30 days.

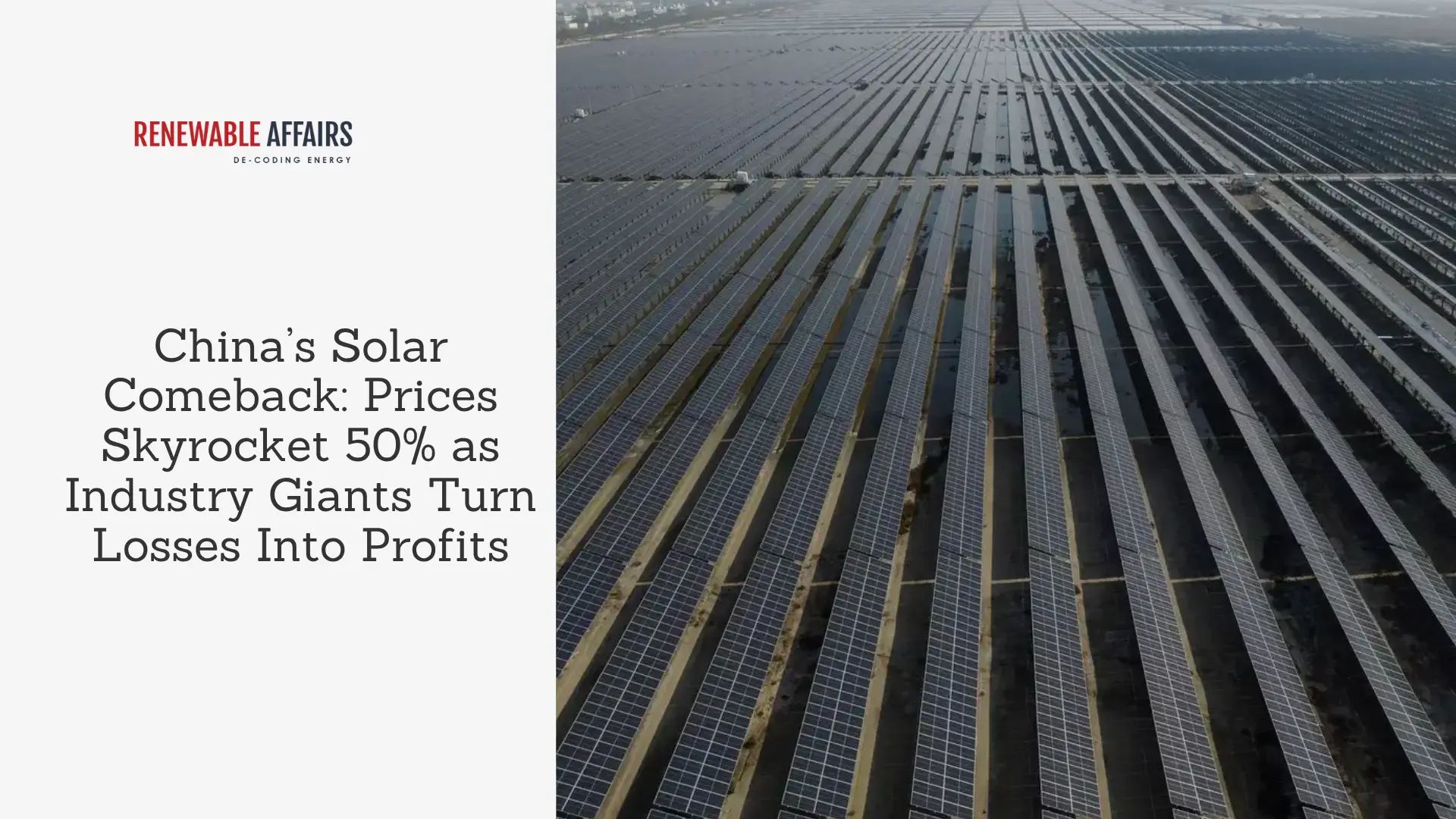

However, the challenges remain primarily the domination of China in solar manufacturing. Currently, China controls over 80% of the world’s solar panel supply, with a massive 95% dominance in polysilicon, ingots, and wafer production, the core materials for solar panels.

Even after India imposed a 40% basic customs duty on Chinese imports, a Chinese solar panel costs ₹14 per watt, while an Indian-manufactured panel costs ₹22 per watt. This price gap continues to make domestic manufacturing less competitive.

However, with policies like the Production-Linked Incentive (PLI) scheme, India is strategically boosting its solar manufacturing capacity. Additionally, Europe and the U.S. have already imposed restrictions on Chinese solar imports, opening up massive export opportunities for Indian manufacturers.

The investor community’s silence on solar is a bit fascinating. While industrial and commercial solar adoption has been rising consistently since 2014, residential solar is still in its early stages. This makes it one of the last untapped markets in the renewable sector.

India currently adds 50,000 solar-powered homes per month, and this number is expected to touch 200,000 per month soon. Unlike the tech startups, the market is highly diverse, with a significant white space for businesses in installation, financing, and maintenance services. Solar is a long-term, cash-generating asset, making it particularly attractive to investors who understand its economics.

For industrial players, the business case for solar has been clear for a long period of time. As a factory owner, the payback period for installing solar is just 3-4 years, after which electricity is virtually free for the next two decades.

Energy costs remain one of the highest operating expenses for industries, and solar provides a direct and reliable way to reduce these costs while becoming energy independent. The Industrial and commercial sectors have already seen mass adoption, unlike residential solar, a trend that is only expected to grow stronger with rising electricity prices and government incentives.

A key shift in consumer behavior is also worth the attention. Earlier, solar was an unattractive financial decision for middle-class families because its payback period was 8–10 years. Today, the payback has fallen to just 3–5 years, and in high-tariff states like Maharashtra, it is as low as three years.

The concept of net metering, which allows households to feed excess electricity back into the grid and offset night-time consumption, has removed the uncertainty associated with solar power reliability. However, mass adoption is still a long way to go due to a lack of awareness, and upfront investment concerns.

The real opportunity lies in the business side of solar— “The supply chain”, financing, installation, and maintenance. OEMs like Tata, Adani, and Waaree control manufacturing, the biggest untapped market is in residential rooftop solar installation and financing solutions.

If the past decade was about large-scale solar farms and corporate adoption, the next decade belongs to residential and decentralized solar solutions. This shift is critical in many ways not just for reducing India’s dependence on coal and oil but also for creating a more resilient energy infrastructure.

India’s electricity grid, once a marvel of engineering, is now an aging, inefficient system struggling with increasing power demand.

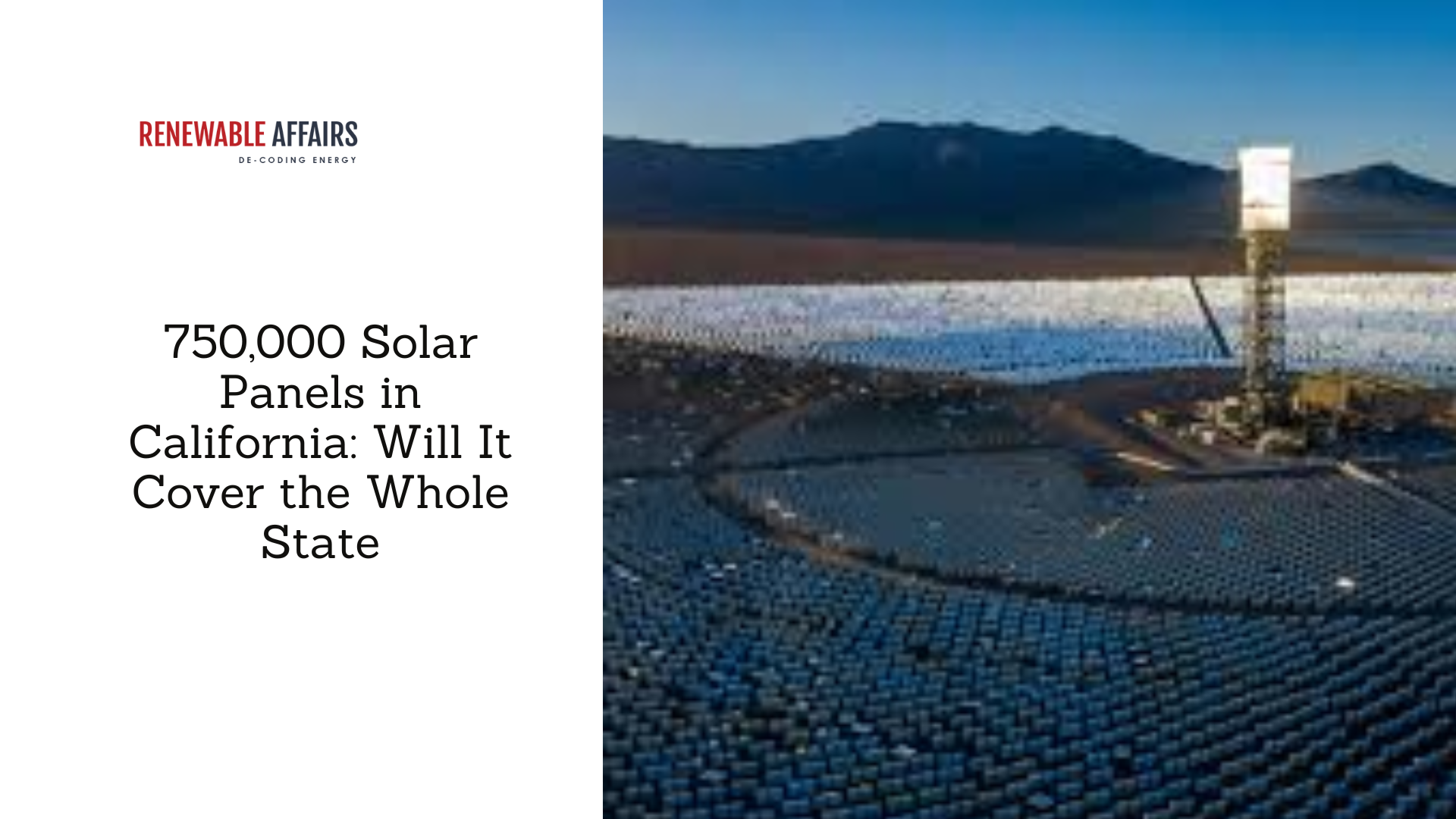

Elon Musk once said that a 100-mile x 100-mile solar farm in Nevada could power the entire U.S.. When the same logic is applied to India, 6,000 square kilometers of solar could make the country energy-independent. The only question left is: Who will take advantage of this opportunity first?

Solar is not just an environmental or futuristic movement—it is an economic revolution and belongs to the present. This is the decade to build, invest, and capitalize on India’s transition to a solar-powered future.

0 Comments