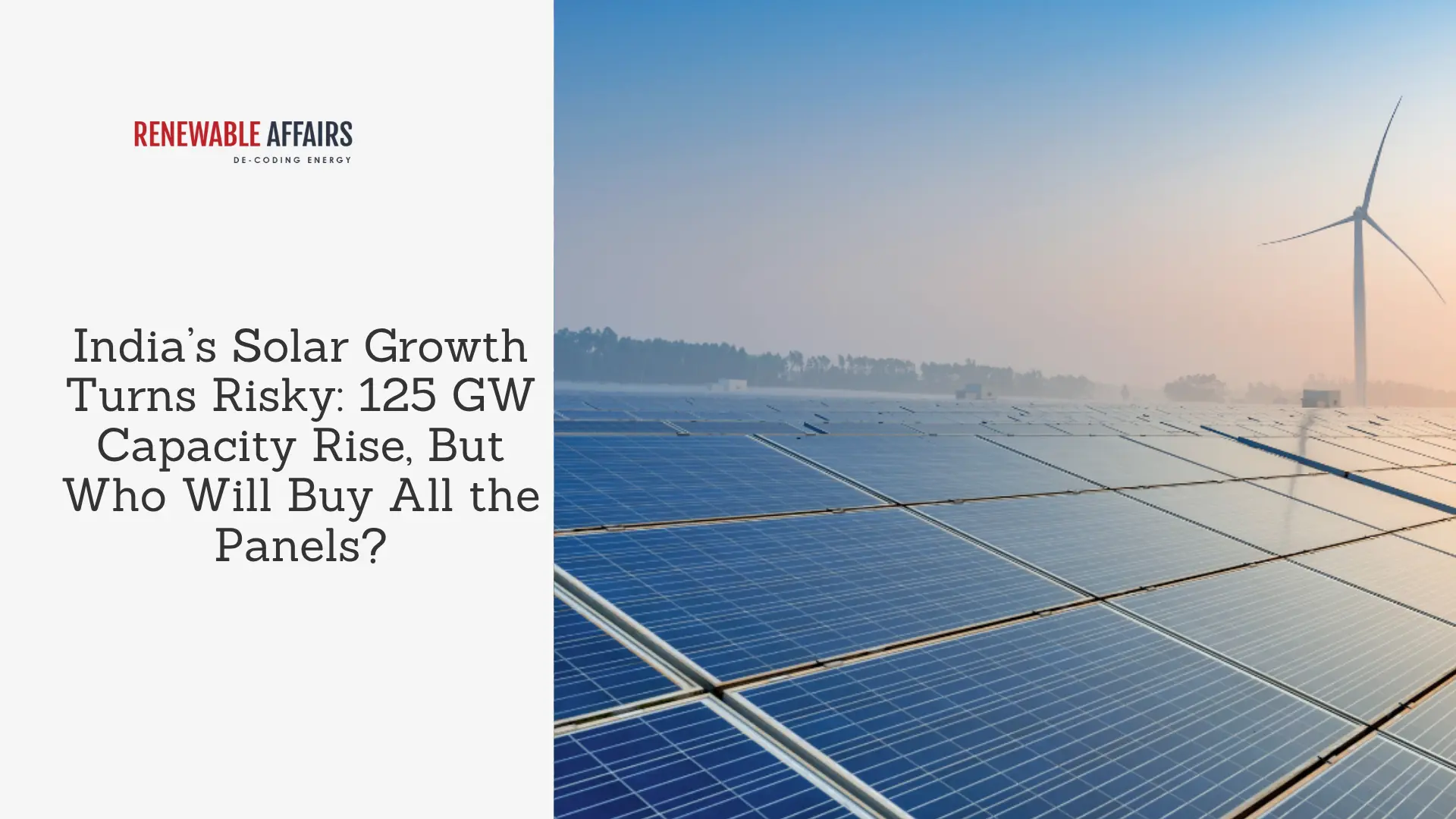

At the recent China Photovoltaic Industry Association (CPIA) annual conference, SinoLink Securities revealed some interesting insights into the shifting cost structure of the solar industry.

Secondary materials such as aluminum frames, packaging glass, and silver paste will dominate solar panel production costs, is it a significant transformation in the global photovoltaic (PV) market?

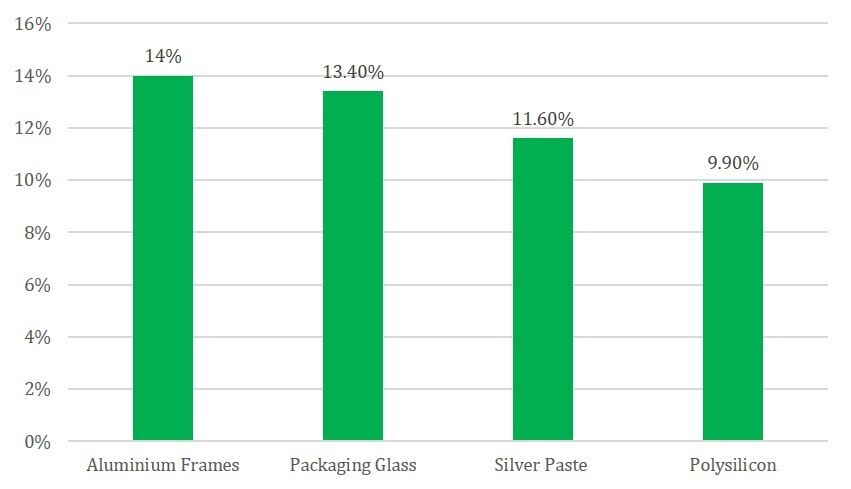

Source: Solar panel costs, 2024 (% comparison)

Aluminum frames are the costliest component by November 2024, contributing 14% of total production costs. Packaging glass followed closely at 13.4%, while silver paste represented 11.6% while polysilicon costs dropped to fourth place at 9.9%.

The hike in aluminum prices, combined with capacity constraints in PV glass production and high silver demand, have significantly reshaped the market.

This global trend presents both challenges and opportunities for India. As a leading player in solar energy adoption, India’s policies and industries could benefit from these cost shifts.

Lower polysilicon costs may ease the production of PV modules, particularly as India speeds up domestic manufacturing to reduce reliance on imports. However, rising costs of aluminum and glass could pressure manufacturers and slow the progress of solar projects.

India’s emphasis on Atmanirbhar Bharat (Make in India) aligns with the growing need to localize solar component manufacturing.

The projected 10-15% annual growth in global solar installations through 2025, and India’s ambitious target of 500 GW renewable capacity by 2030, suggest that the nation could come out stronger.

With strategic investments in innovation and material optimization, India can turn these global challenges into opportunities, reinforcing its position as a key player in the renewable energy transition.

Source:

0 Comments