Switching to sustainable and renewable sources of energy is the need of the hour for every individual and entity. Constant dependence on non-renewable energy sources will deteriorate the condition of this green planet. In the coming time, everyone will be accountable for the depletion of resources like coal, which is instrumental in generating electricity.

In this article, we will discuss the top 10 renewable energy companies in India that are leading the green revolution. On average, renewable energy stocks have shown substantial growth year-over-year, particularly in recent years due to the global push towards sustainability and clean energy.

We will also explore the potential benefits and risks associated with investing in green energy stocks, providing you with valuable insights for informed decision-making.

The Growing Importance of Renewable Energy in India

Government policies are key in moving towards clean energy. Recent budgets have focused on clean energy, making investments in renewable sectors easier.

Market trends also push up the demand for green energy stocks. People are becoming more aware of climate change and new technologies are helping. Electric vehicles and public support for sustainable practices are also driving the trend.

Investing in renewable energy fits with the global move towards eco-friendly solutions. This puts Indian companies in a good spot in the international market. As the sector changes, investors can find new chances to make money.

Why Invest in Green Energy Stocks in India?

As a developing economy, India’s energy demand is set to rise exponentially. This rising demand, coupled with a shift towards clean energy, positions green energy companies for long-term growth, making them attractive to investors looking for high returns.

The Indian renewable energy market is one of the fastest-growing in the world, with the government’s ambitious targets providing a clear growth trajectory. This sector is expected to see substantial growth, which can translate into significant stock price appreciation for companies involved in green energy.

Many green energy companies in India are still undervalued compared to their global counterparts, offering investors the chance to buy into these companies at attractive prices. As the sector matures, these stocks have the potential for re-rating and significant capital appreciation.

The growing interest in renewable energy is likely to boost more initial public offerings (IPOs) in this sector, providing investors with opportunities to get in early on promising companies.

India’s Leading Renewable/Green Energy Stock

Here are the top ten renewable energy players in India that are playing a crucial role in ensuring that the world is more clean and green in the coming time. Let us give you a sneak peek of green energy stocks in India, their benefits, and more.

Adani Green Energy Limited

The first-ranked company on the list is Adani Green Energy Limited because of the company’s exceptional contribution to making the future more sustainable. AGEL is one of the Adani Group’s subsidiaries. It excels in generating wind and solar power and boasts an extensive capacity to conduct its operation. The electricity this company produces by converting solar and wind energy is nationally and regionally distributed.

The current share price of Adani Green Energy Ltd is ₹1,920.85 on the NSE and ₹1,918.95 on the BSE as of Aug-2024 IST. Over the last three years, the company has seen a return of 27.09%. With a market capitalization of more than ₹ 3 trillion, Adani Green Energy holds a significant position among green energy companies.

Main Projects

- Hybrid energy plant (20 GW) in Kutch district in Gujarat

- A green energy park (726 sq km) in Rann of Kutch in Gujarat

TATA Power Solar Systems Limited

One of the country’s top integrated solar energy production companies is TATA Power Solar Systems Ltd. It operates under the TATA Group and possesses an outstanding solar power generation capacity (3136 MW) portfolio. Aside from conducting solar power projects, it produces solar cells, and modules and renders services pertinent to solar products engineering, procuring and construction.

Tata Power Company Limited has a market capitalization of approximately ₹1,35,482 crore. The share price of Tata Power is currently trading at ₹422.65 on the NSE and ₹423.10 on the BSE. Over the past three years, Tata Power has delivered a return of approximately 49.61%. This strong performance is indicative of the company’s growth in its investments in renewable energy.

Main Projects

- A solar power facility (300MW) in Dholera, Gujarat

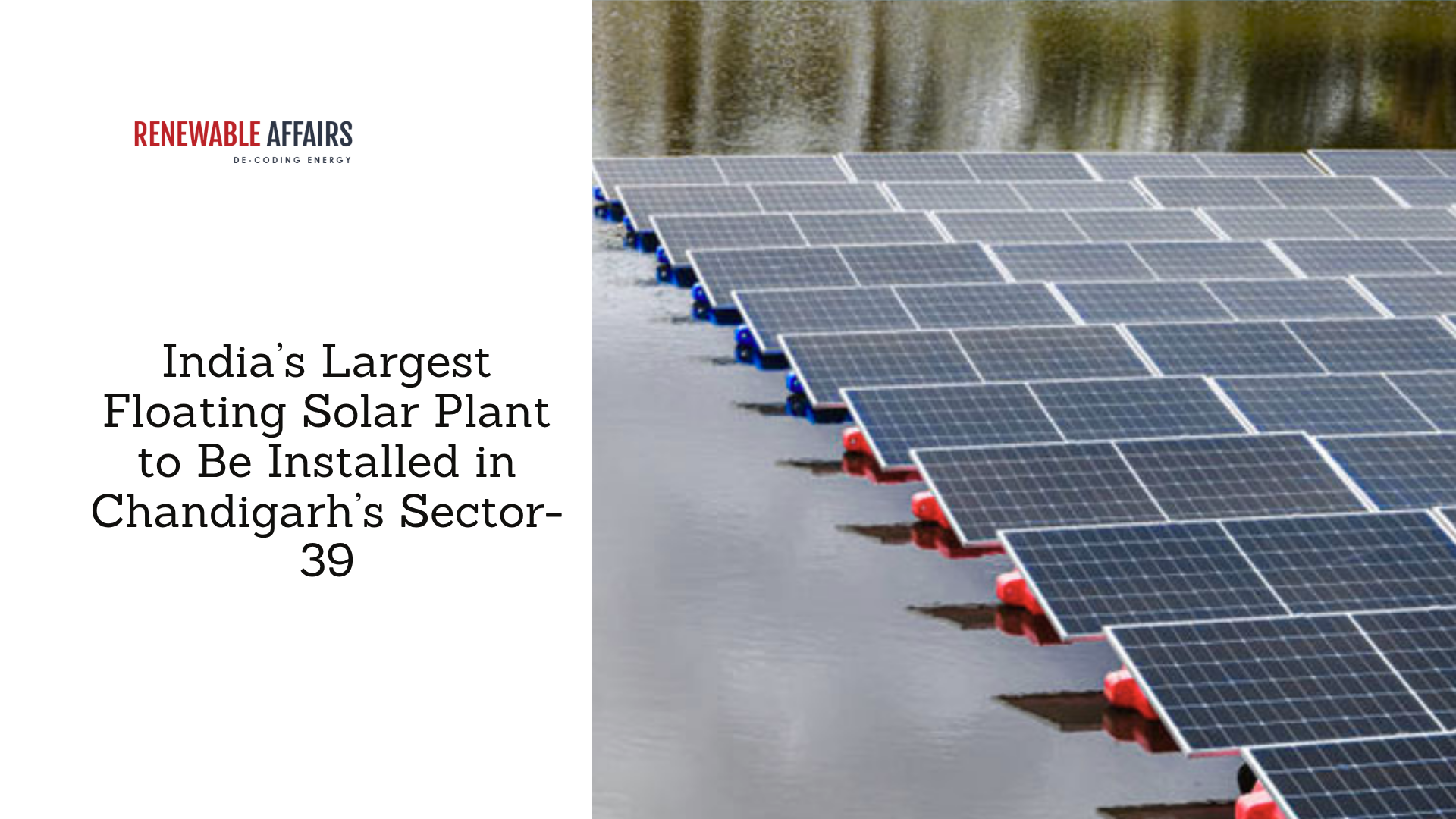

- A floating solar energy project (101.6 MW) in Kayamkuam in Kerala

Know More: Top 10 Solar Panel Manufacturers in India

JSW Energy Limited

JSW Energy Ltd is a part of the JSW Group, which specializes in developing and operating hydropower projects. It is one of those renewable energy companies in India to optimize the use of natural energy by employing advanced technologies. Currently, it is the only company with the highest capacity to generate hydropower.

JSW Energy’s market cap is approximately ₹1.24 trillion. This reflects the company’s substantial presence and growth in the energy sector. The stock is currently trading at around ₹ 708 per share. Over the past year, JSW Energy has delivered a nearly 100% return to its investors. On a larger perspective, the company’s three-year return stands at over 200%, demonstrating strong and consistent performance.

In the last six months, JSW Energy’s stock price has increased by about 48.35%. This consistent upward highlights strong investor confidence and the company’s robust financial performance.

Main Projects

- Hydroelectricity project (1500 MW) in Nashik

- Wind power project (5000 MW) in Solapur, Kolhapur, Osmanabad and Satara

Inox Wind Limited

Inox Wind Ltd.’s main focus is on developing wind farms and wind turbines extensively. It is a renowned company that plays an instrumental role in the production and distribution of renewable energy. Inox Wind provides components and equipment for wind farm projects and constructs wind power plant infrastructure.

The share price of Inox Wind is ₹225.85 on the NSE and ₹225.00 on the BSE. The company has a market cap of approximately ₹29,335 crores (₹293.35 billion), making it a significant player in the renewable energy sector. Over the past year, Inox Wind has delivered an impressive return, with its stock price increasing by around 341.94%. The company has also shown a substantial 47.76% growth over the past month.

Main Projects

- The company will be installing wind turbine generators (3.3 MW) in Dayapar in Gujarat

- NTPC Renewable Energy Ltd has assigned a wind energy project (150 MW) to Inox Wind Ltd.

Suzlon Energy

One of India’s esteemed renewable energy solution providers is Suzlon. It excels in providing a package of different aspects pertinent to wind energy projects. This company has extensive experience designing, developing, and producing wind turbine generators. The capacity of its installed wind energy in India is 13.76 GW.

Suzlon Energy Limited is performing strongly in the market with approximately ₹1,10,160 crores (₹1.1 trillion), in market capital. It has seen a remarkable increase of over 300%, reflecting strong investor confidence and market momentum. The share price of the company is ₹78.85 on the NSE. Suzlon has delivered a return of about 424% over the last year, driven by its strategic expansion and operational efficiencies.

Main Projects

- Installation of 15 WTGs with a capacity of 31.5 MW in Karnataka and Maharashtra

- A wind power project (300 MW)

Read More: Best Wind Energy Companies in India

Sterling and Wilson Renewable Energy Ltd

Sterling and Wilson Renewable Energy Ltd, a top-rated global EPC manufacturing company in India, provides complete services related to engineering, obtaining, and manufacturing solar products. The company is also an expert in generating large-scale solar energy and installing floating solar panels and hybrid systems.

The company has been recovering after a tough time. Recent quarters have seen big jumps in revenue. However, making a profit is still a worry. For FY 2023-2024, the company’s EBITDA was ₹62.9 crores. This is a 51% increase in revenue from the year before. The share price has fluctuated between ₹253.00 and ₹828.00 with a market capitalization of ₹16,195.6 crores.

Main Projects

- A solar power project (375 MW) in Anantapur, Andhra Pradesh

- Two prominent projects in Vietnam (104MW and 168 MW)

- A couple of projects in Chile (170 MW and 190 MW)

Borosil Renewables

Borosil Renewables is a well-reputed solar glass manufacturing company in India. It is crucial in catering to nearly forty per cent of India’s total demand for solar glass. Borosil Renewables supplies its manufactured solar glasses to multiple countries, including Spain, Turkey, Germany, Portugal, and Russia.

Borosil Renewables Limited is a significant player in India’s renewable energy sector, with the company’s market cap is approximately ₹8,109 crore. The stock has demonstrated a substantial long-term appreciation, with a five-year return of around 300.94%.

Main Projects

- Develops 2mm thickness fully-tempered solar glass

- It produces solar glass free of Antimony

ReNew Energy

Renew is one of the well-known renewable energy companies in India. It specialises in producing wind and solar power. ReNew Energy’s production capacity is 25.20 MW, and it sells the electricity it generates to industrial businesses and state electricity boards.

ReNew Energy Global Plc (RNW) has a market capitalization of approximately USD 2.18 billion, with a share price of around $5.92.

Main Projects

- Yellow Pine solar project

- BP’s Morgan and Mona offshore project

- Baltic power offshore wind farm

- Dogger Bank wind farm

Websol Energy System

Websol specializes in manufacturing photovoltaic monocrystalline modules and solar cells. It is sought-after for exporting premium-quality solar cells to North Africa and Europe. The production plant of this company is in West Bengal, India. It has received several certifications from different parts of the globe for its accomplishments.

As of August 2024, Websol Energy System Limited is experiencing significant market activity. The company’s share price is at ₹986.40. Websol Energy has seen a tremendous surge in its stock performance over the past year, with a one-year return of approximately 705.68%, making it one of the top performers in the renewable energy sector in India.

Main Projects

- Mono PERC cell production with a capacity of 1.8GW

Read More: Top 10 Solar EPC Companies in India

KP Energy

One of the trusted wind energy production companies in India is KP Energy. The capacity is around 29.4 MW and its production unit is in Gujarat. It has won many accolades for contributing to a cleaner and sustainable future.

With a market cap of 2975 cr and 17.23% 5-year ROI, these figures underscore the company’s commitment to growth and its solid performance in the market. As KP Energy Ltd continues to expand its footprint in the wind power market, it remains a compelling option for investors interested in green energy stocks.

Main Projects

- A wind energy farm at Matalpar

- A wind power project at Fulsar and Bhungar

Know More: Top 10 Solar Panel Manufacturers in Gujrat

Investment Opportunities & Risks Associated With Investing In Green Energy Stocks

Investing in green energy stocks offers many chances for growth. But, it also comes with risks. Knowing these can help you make smart choices.

Benefits of Investing in Green Energy Stocks

1. Portfolio Diversification:

Green energy stocks allow you to diversify your investment portfolio, reducing reliance on traditional fossil fuels and enhancing financial stability.

2. Government Incentives:

You may benefit from various government initiatives aimed at promoting renewable energy. These include tax rebates, subsidies, and favourable regulatory frameworks that can enhance profitability.

Challenges Related to Intermittent Power Sources

While exploring green energy investments, consider the challenges posed by intermittent power sources like solar and wind:

1. Dependence on Weather Conditions:

The availability of sunlight and wind can fluctuate, affecting energy output and reliability.

2. Impact on Investments:

This intermittency complicates long-term planning for energy production and may impact some investors.

Conclusion

India’s priority for renewable energy sources is commendable. Harnessing the potential of natural, clean sources of energy can help meet the growing energy demand and protect the environment. India’s leading renewable energy companies are instrumental in improving energy security, economic growth, and environmental sustainability.

It’s crucial to conduct thorough research before making any investment decisions in this evolving space. Understanding market dynamics and company fundamentals can help you make informed choices that align with your financial goals.

0 Comments