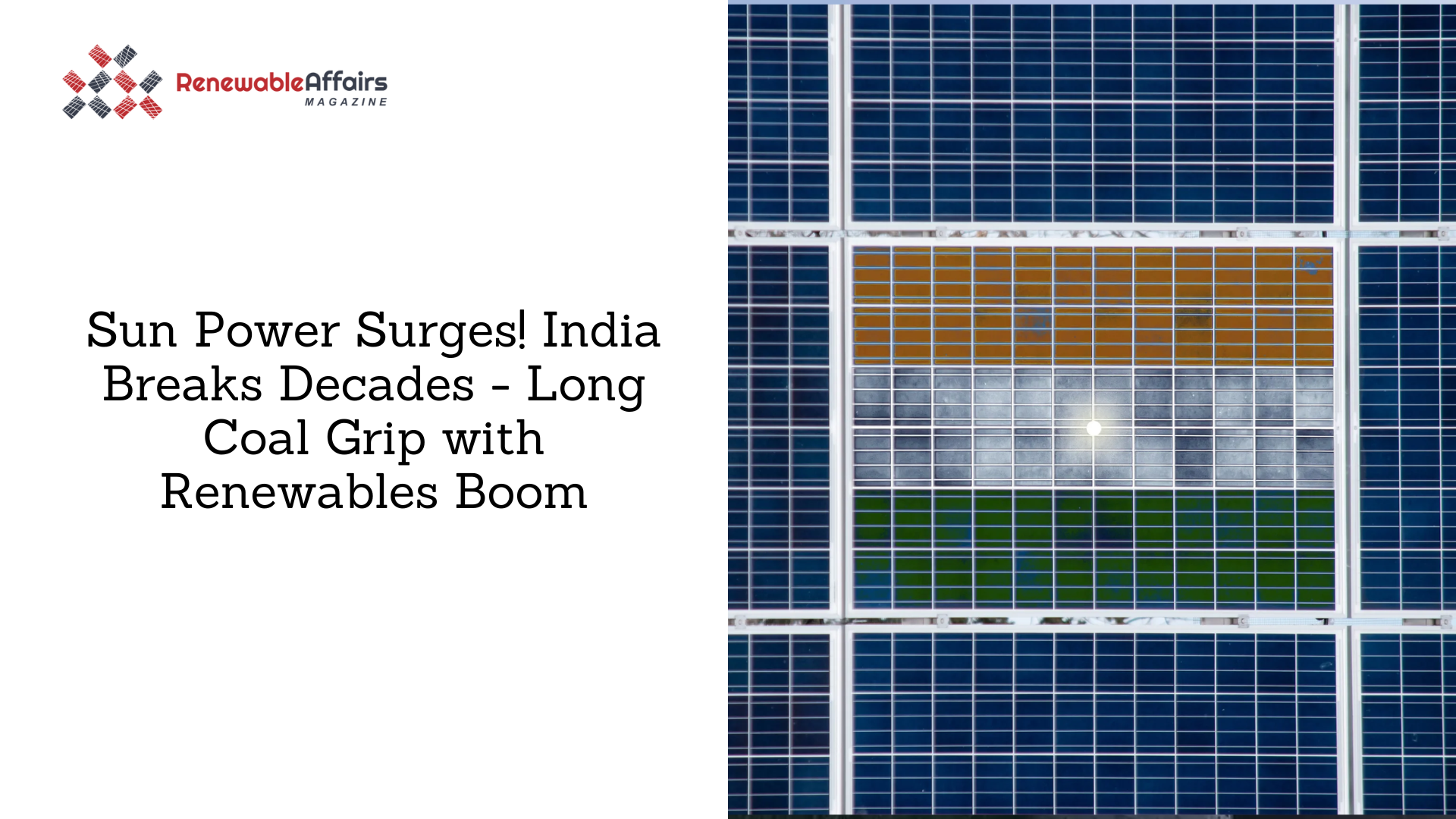

Nuvama has rated Waaree Energies as a Buy and set a target price of ₹4,150 per share, about 17% higher than its current price. The company is doing well, its profit doubled in the second quarter of FY26, and its production increased by 42% over the last year.

Waaree continues to strengthen its position in the solar energy market with a solid order book and large expansion plans. It has maintained its FY26 EBITDA guidance of ₹5,500–6,000 crore, showing confidence in its financial performance.

Nuvama said that Waaree’s ₹5,100 crore net cash and strong ₹5,000 crore annual EBITDA give it a solid balance sheet to handle its planned ₹25,000 crore investment in new projects.

Waaree Energies plans to produce more solar cells in the second half of FY26 because it is increasing its production capacity. The recent GST reduction from 12% to 5% will also help the company make more profit. Its exports are growing quickly, with strong demand from the EU, Gulf countries, the UK, Africa, and Australia. In the U.S., Waaree is keeping costs under control through a well-diversified supply chain and by using tax benefits.

Nuvama also noted that Waaree is moving beyond just solar panels and entering new green energy areas like inverters, electrolyzers, green hydrogen (GH2), and battery storage systems (BESS). These steps will help the company reduce risks and take advantage of new opportunities in the renewable energy sector.

By the end of Q2FY26, Waaree had orders for 24 GW of solar projects worth around ₹47,000 crore. Its subsidiary, Waaree Renewables Technologies (WRTL), also had projects totaling 3.5 GW.

Nuvama expects Waaree Energies’ earnings (EBITDA) to grow by 43% each year from FY25 to FY28, thanks to strong sales and ongoing expansion. With rapid growth, a variety of projects, and strong finances, Waaree is becoming one of India’s leading solar companies. Nuvama thinks these strengths could make it one of the top-performing stocks in the renewable energy sector.

Source

0 Comments