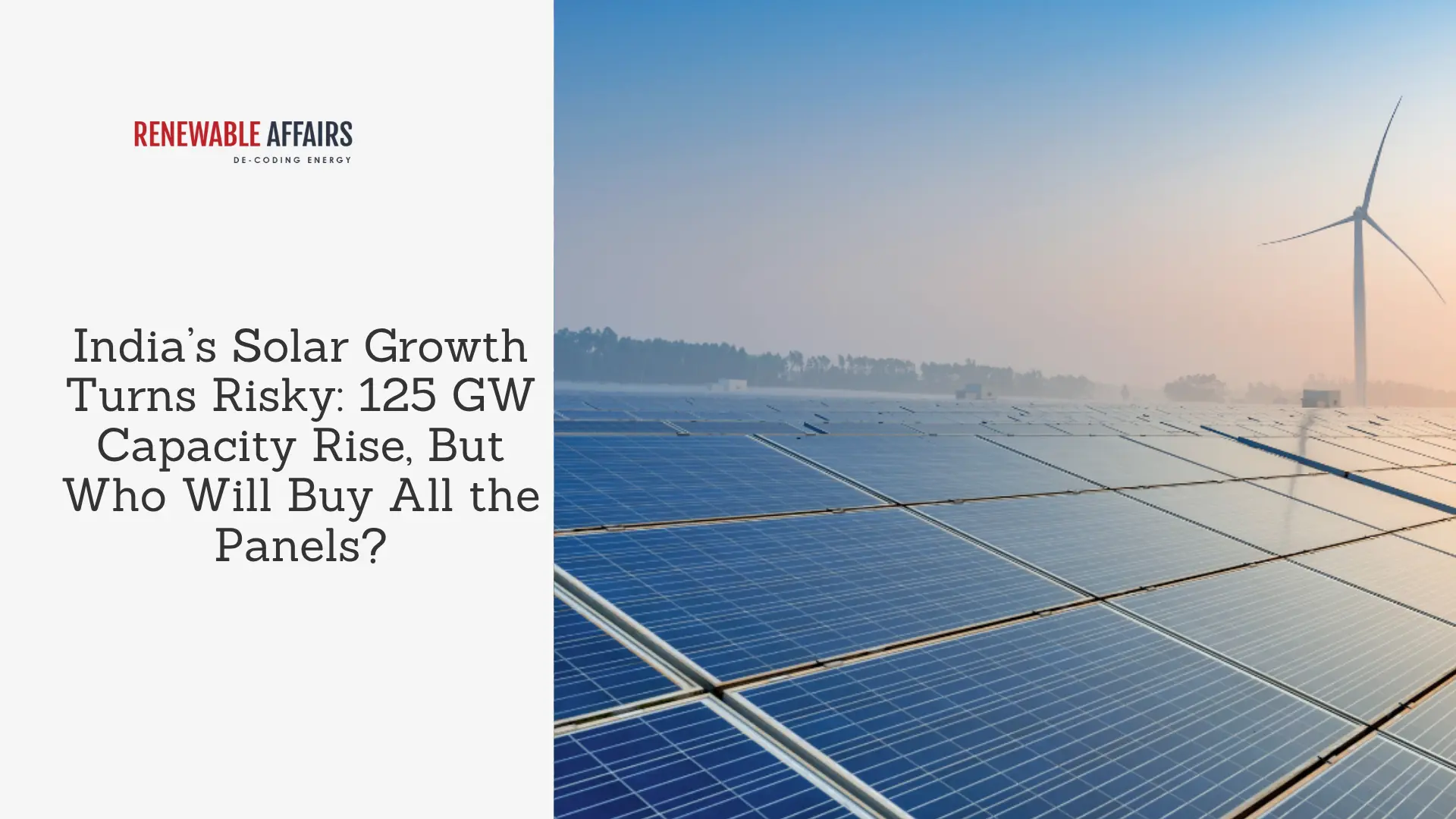

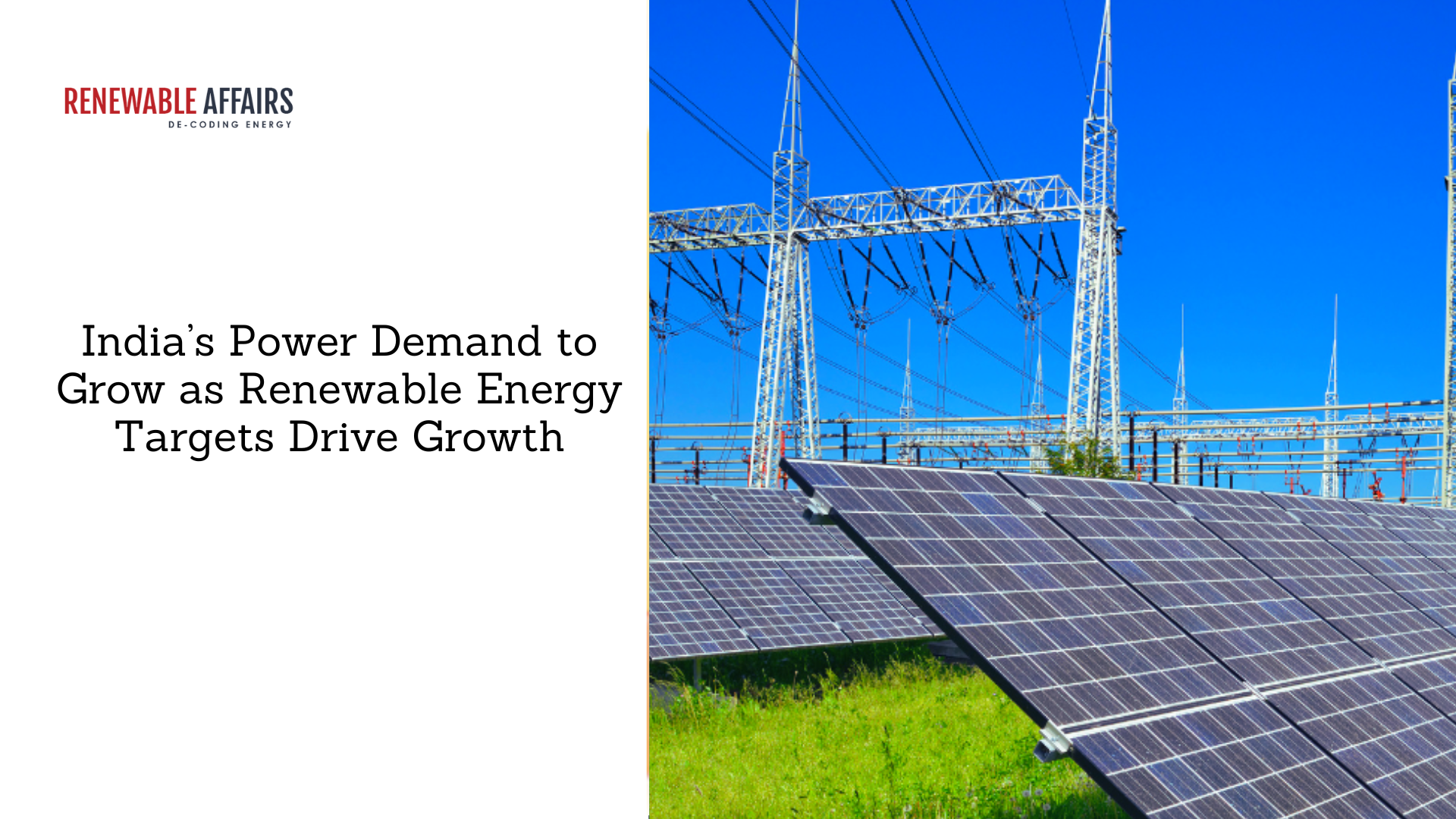

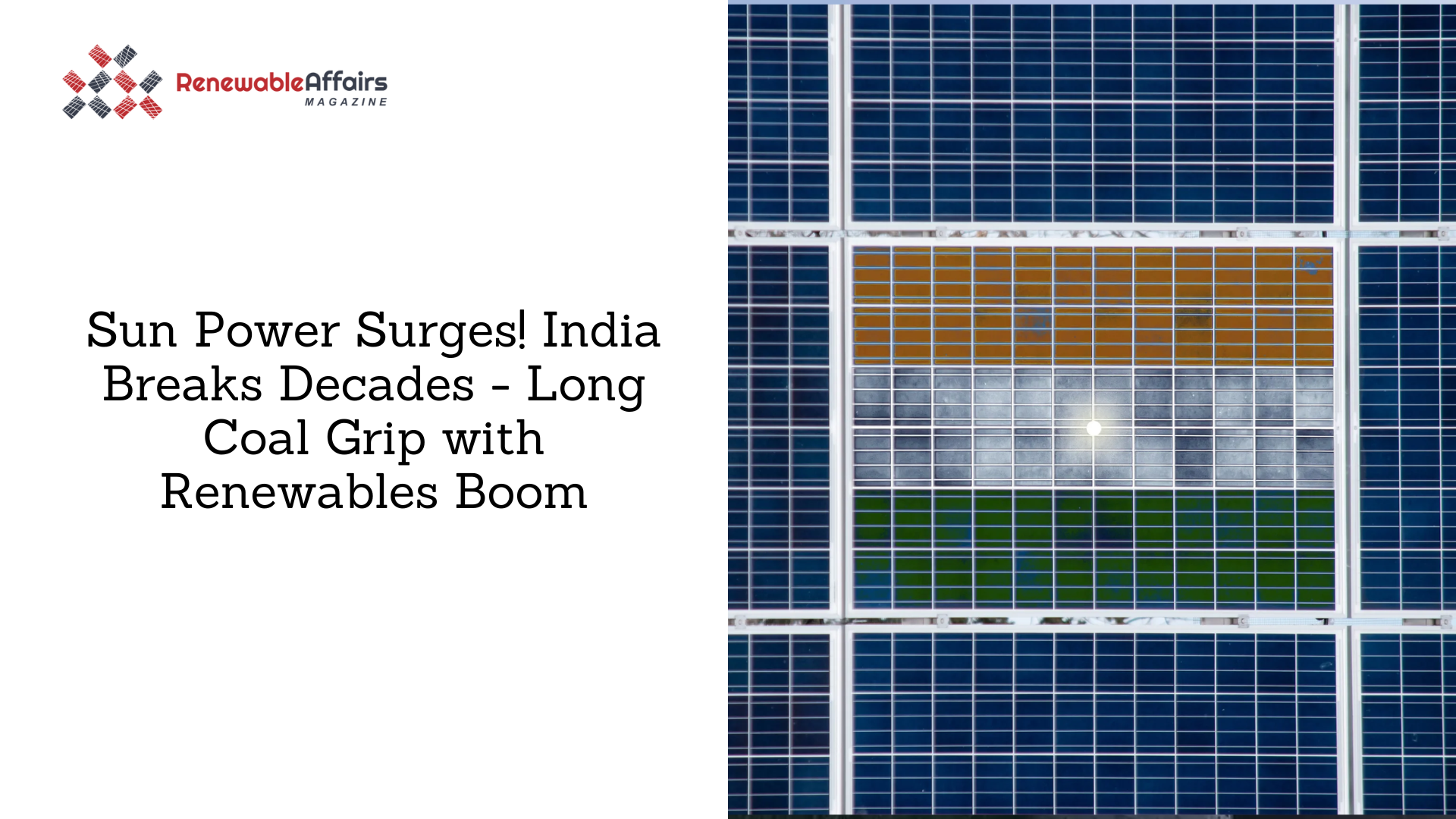

India has shown remarkable growth in the renewal energy capacity in FY23-24. In the current CEEW Centre for Energy Finance (CEEW-CEF) Market Handbook, it’s stated that Solar energy dominates the other renewable energy accounting for approximately 15 GW or 81% of the renewable capacity. In addition, wind energy was also doubled by 3.3W from 2.3W in FY23. For the first time since 2017, solar energy was added in FY 24 with a capacity of 1.4W.

In the 2023-2024 fiscal year, about 71% of the roughly 26 gigawatts (GW) of power generation capacity were added from renewable sources. Therefore, India’s total installed power production capacity has stood at 442 GW, out of which 144 GW (33%) is from RE sources and 47 GW (11%) from hydro. Accordingly, for the first time in India, the coal/lignite capacity shares in India’s total installed capacity are below 50%.

According to a report, India’s renewable energy auctions hit a record with about 41 GW of capacity in fiscal year 2024. Moreover, eight auctions included energy storage this year, showing a trend towards new power procurement methods.

Gagan Sidhu, Director of CEEW-CEF, stated, “In FY24, India nearly met its goal by auctioning 47.5 GW of renewable energy, about three times the capacity added annually in recent years. There’s a shift from standard renewable energy auctions. The auctions featured new methods like wind-solar hybrids, reliable renewable energy, and combined renewable and storage solutions, which accounted for 37% of the total capacity auctioned. With innovative auctions this share may increase to 57% of bids and falling prices for battery storage, this trend is likely to grow.” He further added that the main challenge with renewable energy is to secure enough scale of financing. Specifically, there is a need to triple finance to support the 47.5 GW of RE bids issued. Using the domestic bond market for green corporate bonds could help to achieve this.

The CEEW-CEF report found that India’s peak power demand reached a new high of 240 GW in FY24, driven by rapid economic growth and weather conditions such as low rainfall, higher temperatures in November, and cold spells in North India during the winter. Compared to the previous fiscal year, there was an approximately 8% increase in electricity demand.

Riddhi Mukherjee, a Research Analyst at CEEW-CEF, explained, “To meet India’s growing electricity needs, the Ministry of Power revised the Electricity (Late Payment Surcharge and Related Matters) Rules of 2022 to require the sale of surplus power that hasn’t been requested on power exchanges. This move highlighted the policy changes aimed at improving the liquidity of the power supply and mentioned new initiatives such as PM Surya Ghar: Muft Bijli Yojana, which is designed to increase rooftop solar installations in the residential segment.

The report also pointed out that foreign direct investment (FDI) in non-conventional energy exceeded USD 2 billion for the second year. Additionally, the Reserve Bank of India successfully carried out the auction of four sovereign green bonds, raising a total of INR 20,000 crore to fund environmentally friendly projects.

Source link:

✓ https://solarquarter.com/2024/05/02/india-boosts-renewable-capacity-by-18-5-gw-in-fy-2024-with-solar-contributing-15-gw/

✓ https://www.sarkaritel.com/renewable-energy-accounted-for-71-of-indiaspower-generation-capacity-addition-in-fy24-ceew-cef/

✓ https://www.pv-magazine-india.com/2024/05/02/india-installed-15-gw-of-solarcapacity-in-fy-2024-ceew-cef/

0 Comments