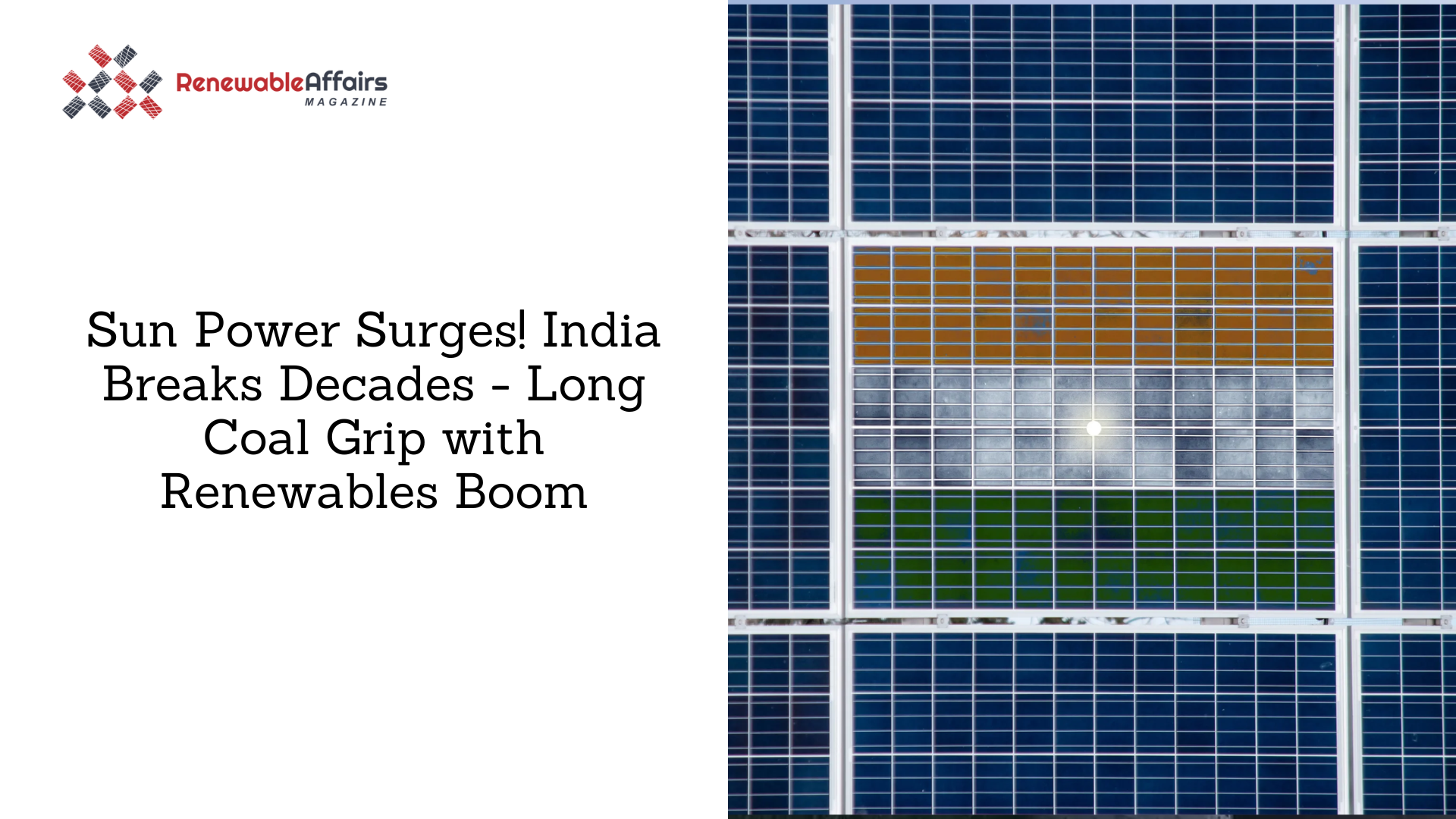

INOX Clean Energy Ltd belongs to the INOXGFL Group. This company is preparing to enter the stock market with a big plan to raise ₹6,000 crore through its upcoming IPO (Initial Public Offering).

The company has secretly submitted its Draft Red Herring Prospectus(DRHP) to the Securities and Exchange Board of India (SEBI), India’s market regulator. This is the largest IPO ever in India’s renewable energy sector. It is larger than the ₹4,300 crore IPO by Waaree Energies and the ₹3,000 crore IPO by Juniper Green.

Most of the IPO will include new shares, and the money raised, ₹6,500 crore, will be used to build and expand the company’s renewable energy projects.

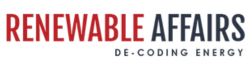

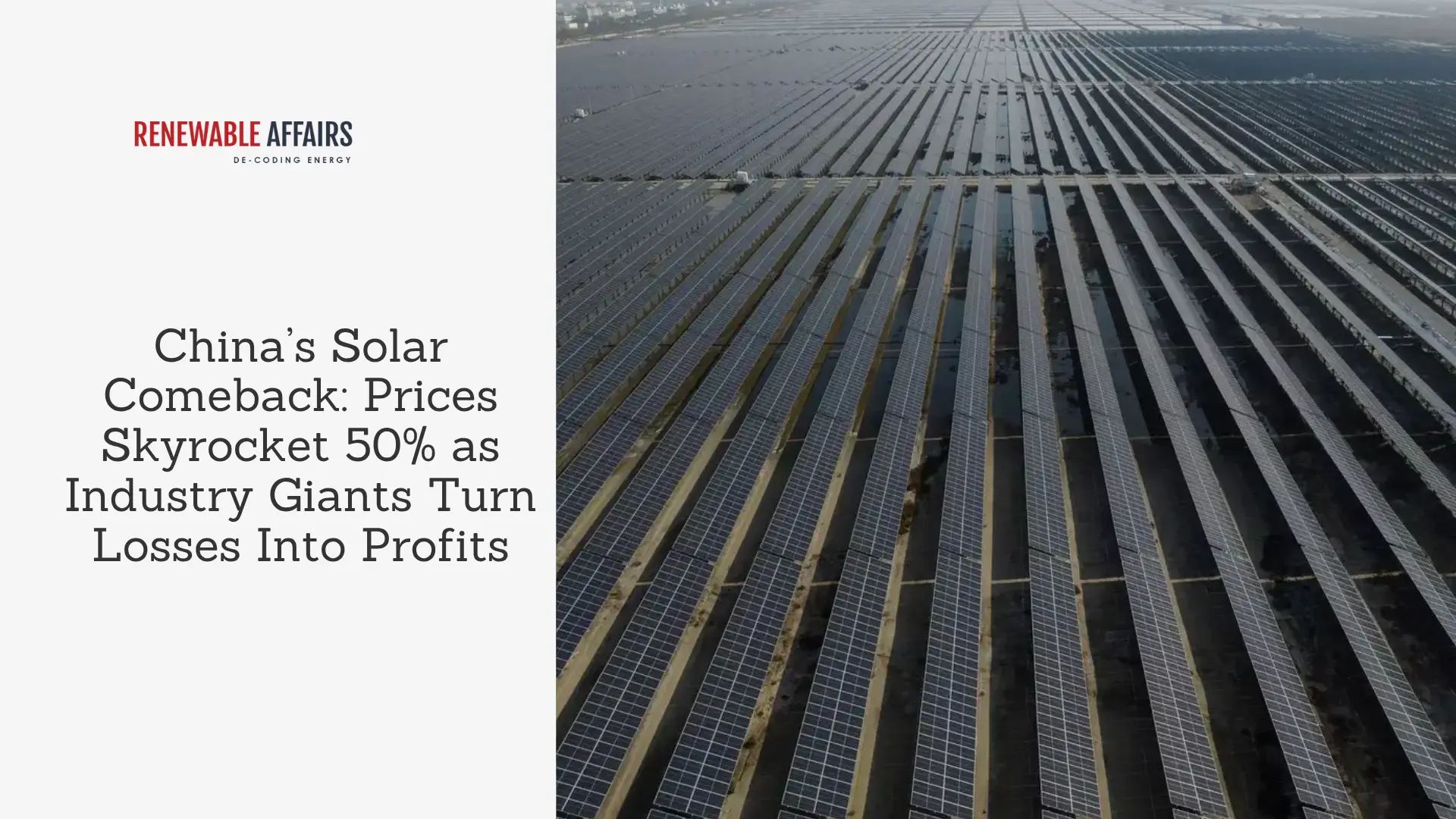

This includes setting up new solar plants and growing its solar manufacturing projects and independent power production capacities.

INOX Clean Energy has chosen five firms, JM Financial, Motilal Oswal, Nuvama, IIFL Securities, and ICICI Securities, as lead managers to handle and oversee its IPO process.

INOX Clean Energy, located in Noida, currently runs 157 MW of renewable energy, 107 MW from wind power, and 50 MW from solar power. The company also makes solar cells and panels.

Besides the IPO, INOX Clean Energy also raised ₹700 crore by selling part of its ownership. The company raised ₹90 crore on its own, and an additional ₹600 crore was raised through Inox Neo Energies by offering small stakes to private investors.

The INOX Group, worth $12 billion and led by Vivek Jain and Devansh Jain, is steadily growing its clean energy plans as India moves toward a cleaner and greener future.

Source

https://groww.in/blog/inox-clean-energy-plans-for-6000-crore-ipo-files-drhp

0 Comments