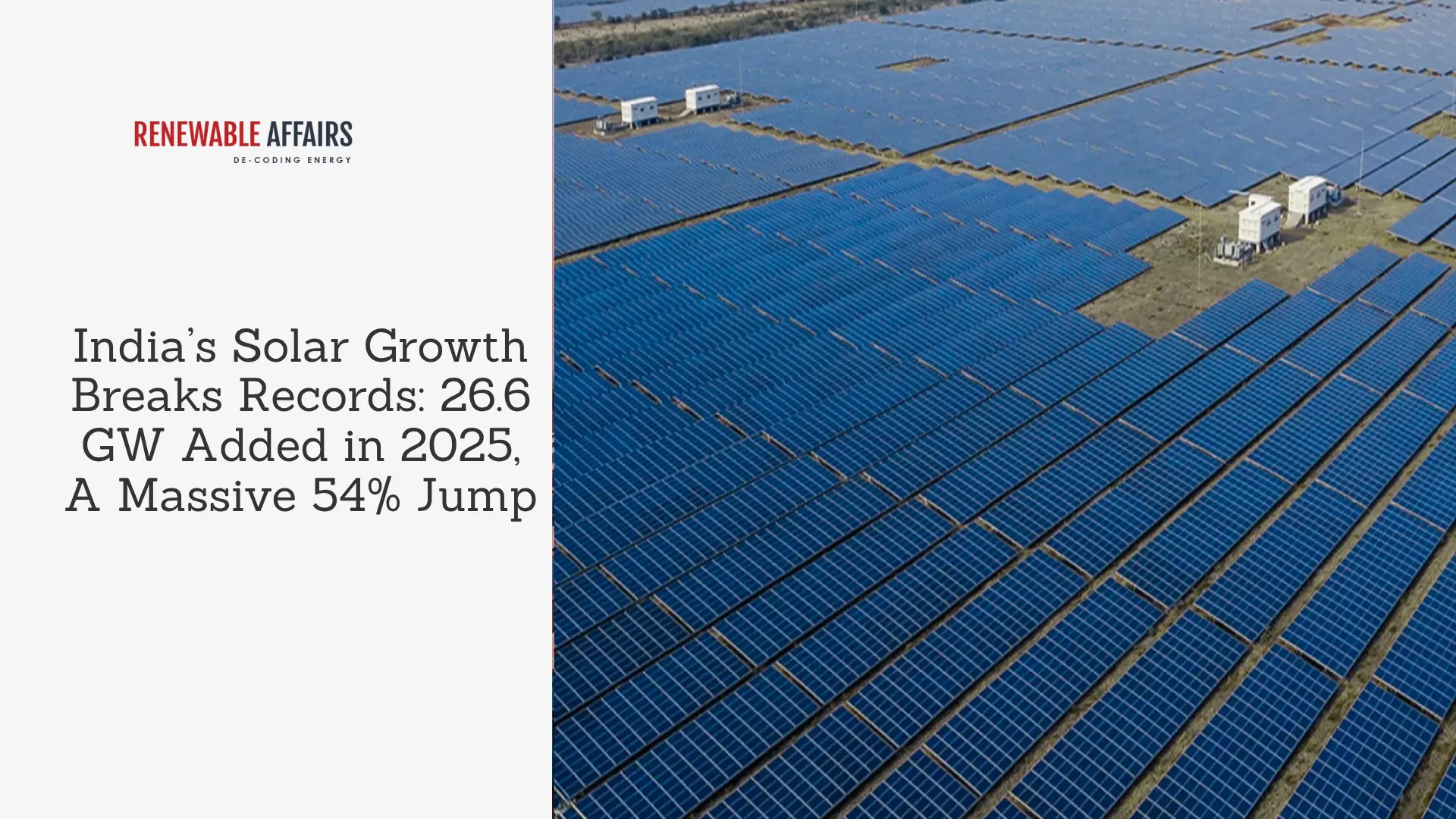

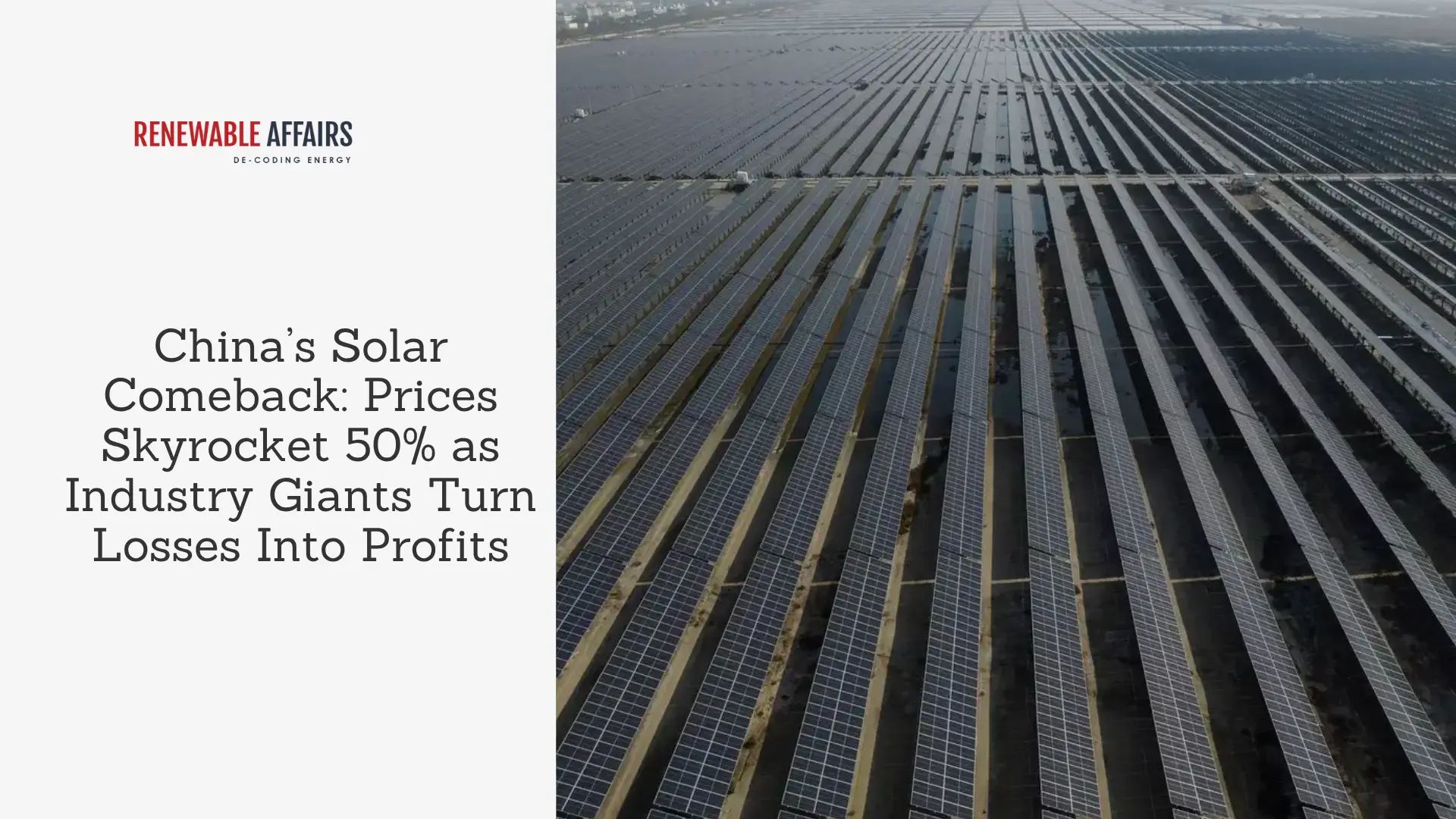

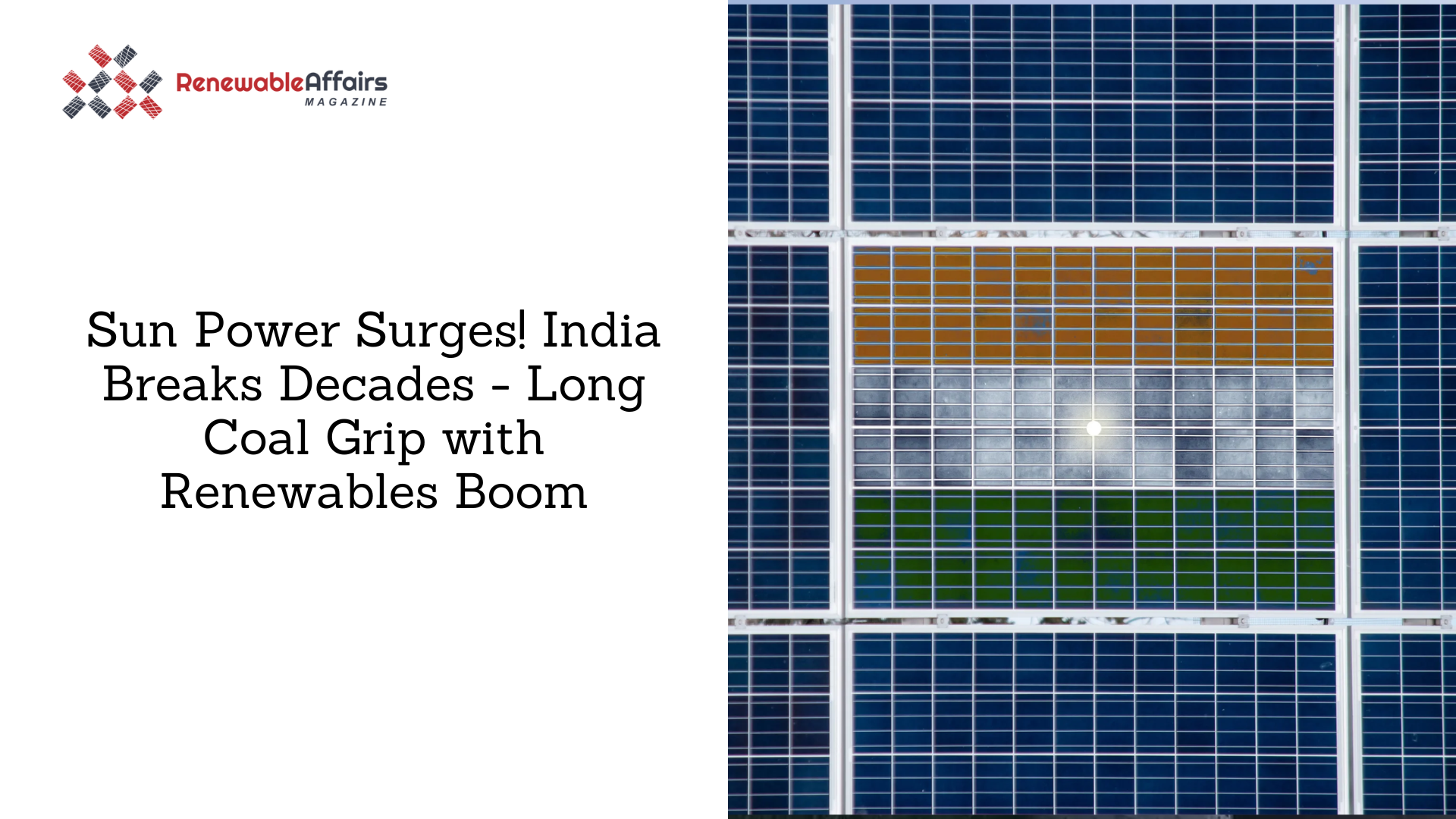

China’s share of cell imports has risen from 70% to 90%. According to official trade data, India’s import of photovoltaic cells from China increased by 141% despite restrictions on the use of imported models in utility-scale and rooftop solar setups.

India’s manufacturing capacity of solar modules has increased from 38 GW in 2024 to 91 GW in 2025. According to MNRE, this increase is due to the rise in domestic solar PV module manufacturing. Despite the growth in India’s solar cell manufacturing capacity from 9 GW to 25 GW, it still fails to meet the total demand for modules in the country.

Though MNRE reimposed the ALMM order in 2025, which placed restrictions on imports, several exemptions under this order—such as projects related to net metering and solar installations for green hydrogen projects—allowed imports to continue increasing, according to the ministry. The Ministry has requested state governments to implement the ALMM order efficiently.

Overall, solar cell imports rose by 88%, but module imports fell by 51%, from 48.48 million panels to 40 million.

India’s Cell Capacity

India aims to achieve a solar cell manufacturing capacity of 100 GW and a wafer capacity of 40 GW, up from the current 2 GW, by 2030. Solar cells are manufactured using wafers made from polysilicon ingots. The ALMM order will also apply to cell imports starting April next year, which will allow domestic cell production to increase.

China’s Challenge

The biggest challenge to increasing domestic production is China’s low-priced product dumping in the country. The Indian trade watchdog, DGTR (Directorate General of Trade Remedies), is investigating anti-dumping cases related to China’s solar cell imports. China dominates the solar value chain globally; therefore, domestic manufacturers face intense competition from Chinese products.

Source https://indianexpress.com/article/business/china-solar-cells-import-10081996/lite/

0 Comments