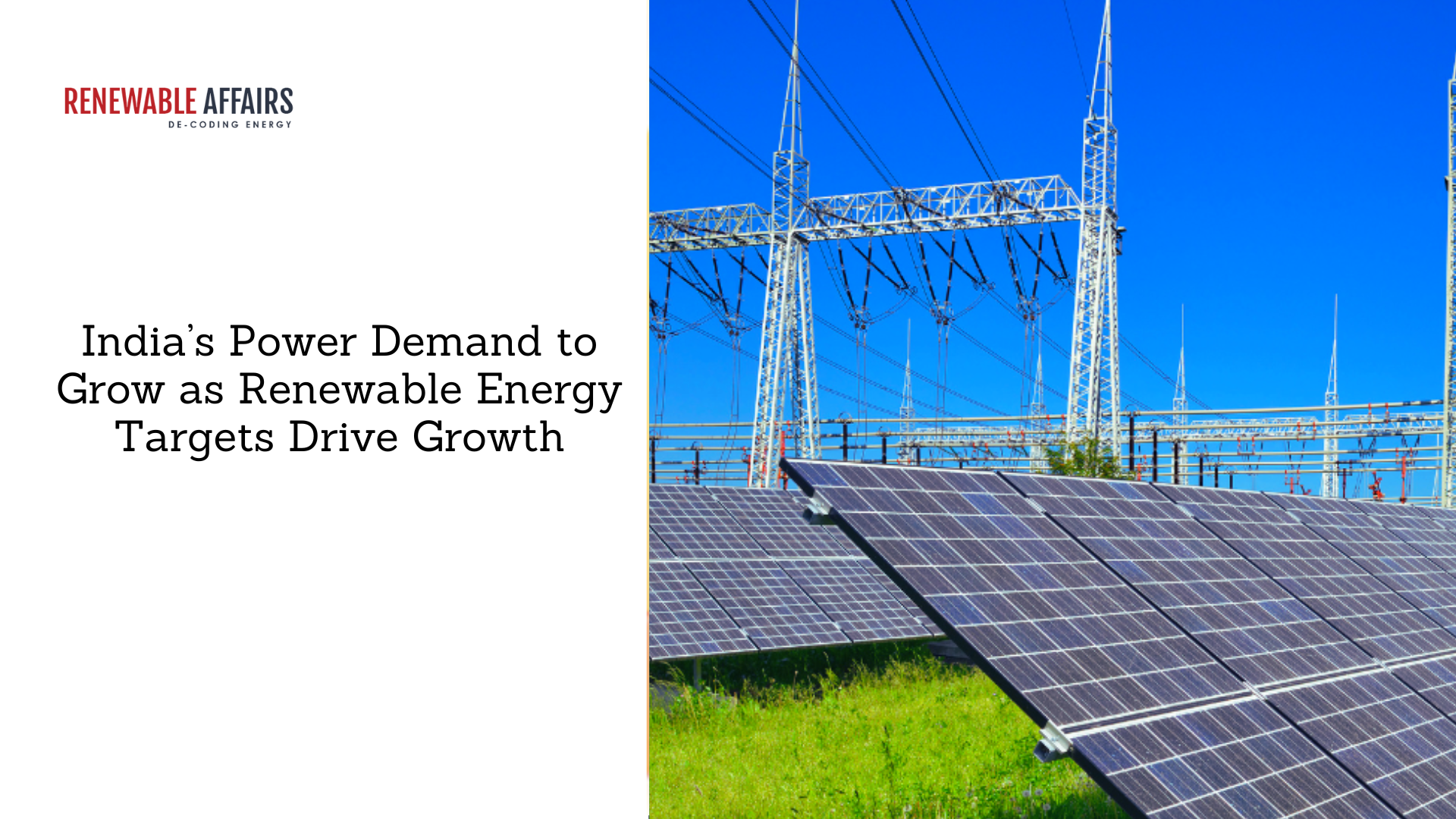

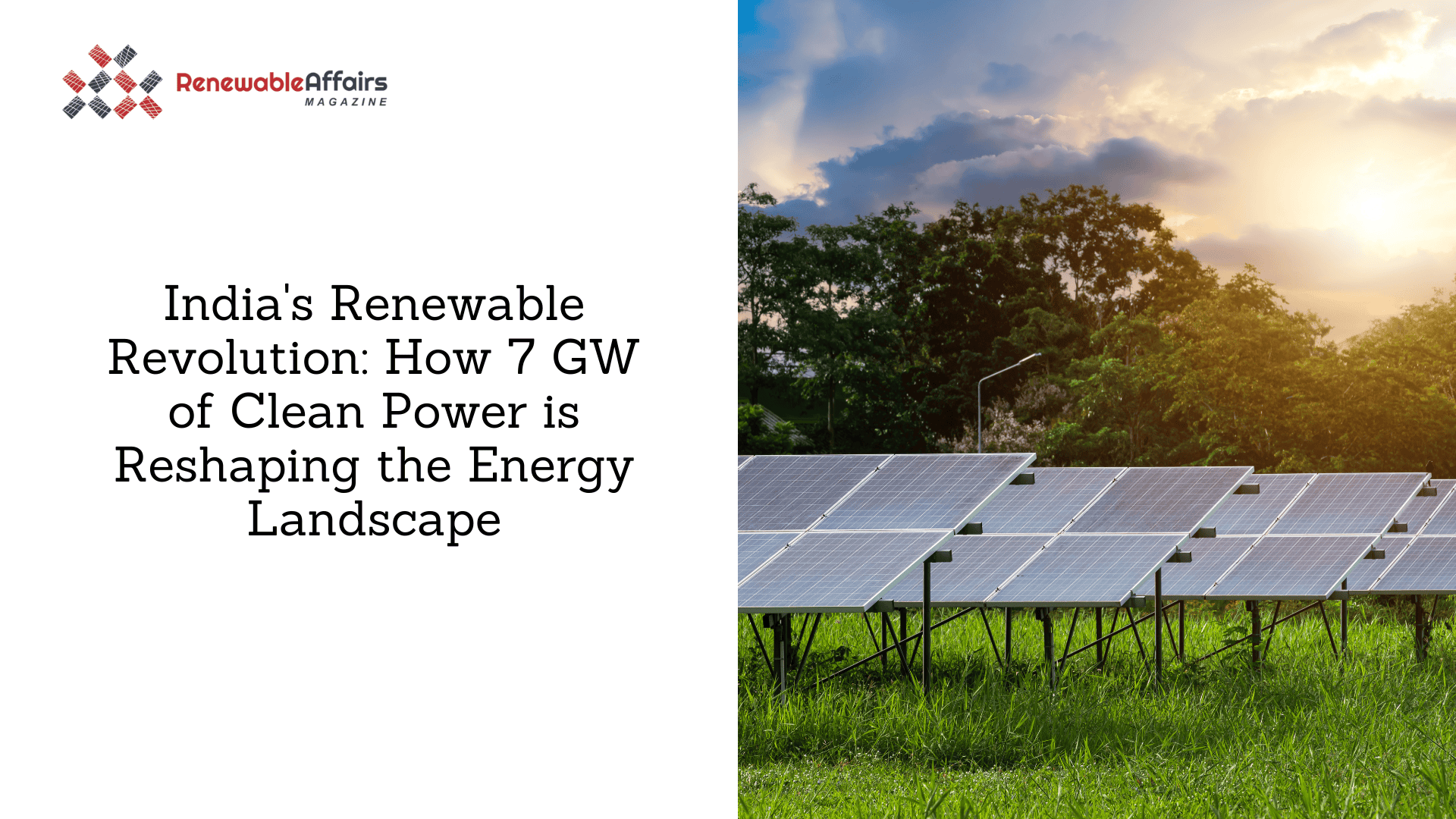

India’s solar power sector is expanding faster than ever. In the first nine months of 2025, the country installed 26.6 GW of new solar capacity. This is 53.7% more than the 17.3 GW added during the same period the previous year.

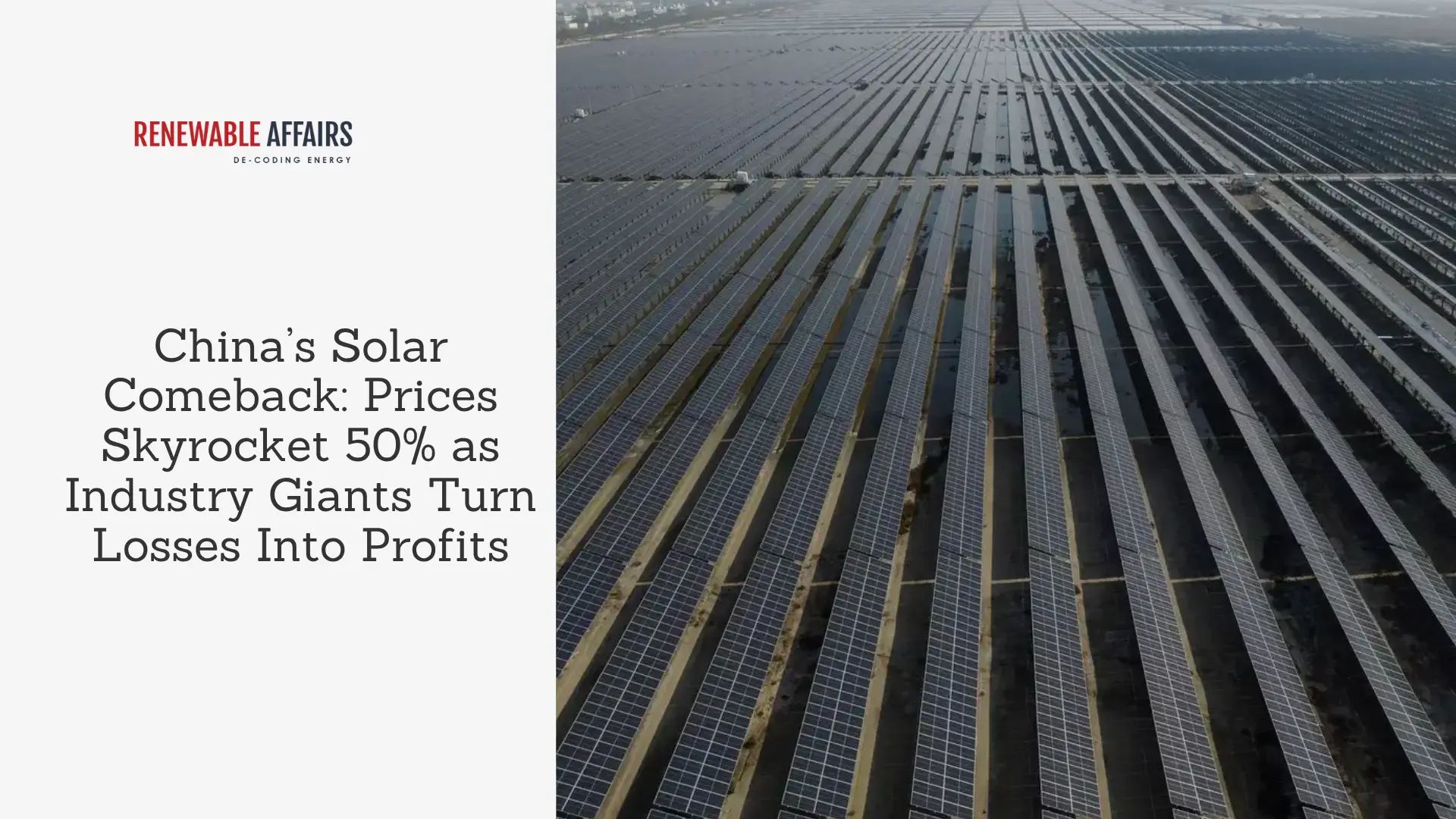

Most of this new capacity came from large solar farms, which contributed 81.5% of the total growth.

Rooftop solar also contributed a healthy 18.5%. The rise was mainly powered by developers rushing to complete projects before the ISTS waiver deadline and the upcoming ALMM-II compliance window.

However, the industry is facing multiple challenges, like supply shortages, grid congestion, and reduced demand. High module prices and limited availability of DCR-compliant components added more pressure. Despite these issues, long-term visibility is improving, experts say.

In Q3 2025, India installed 6.6 GW of large-scale solar, which is a 32.3% drop from the previous quarter but a massive 141% jump compared to Q3 2024. The dip was due to delays in high-voltage equipment, uneven grid readiness, ALMM uncertainty, lack of TOPCon modules, and slow pricing from Tier-1 manufacturers.

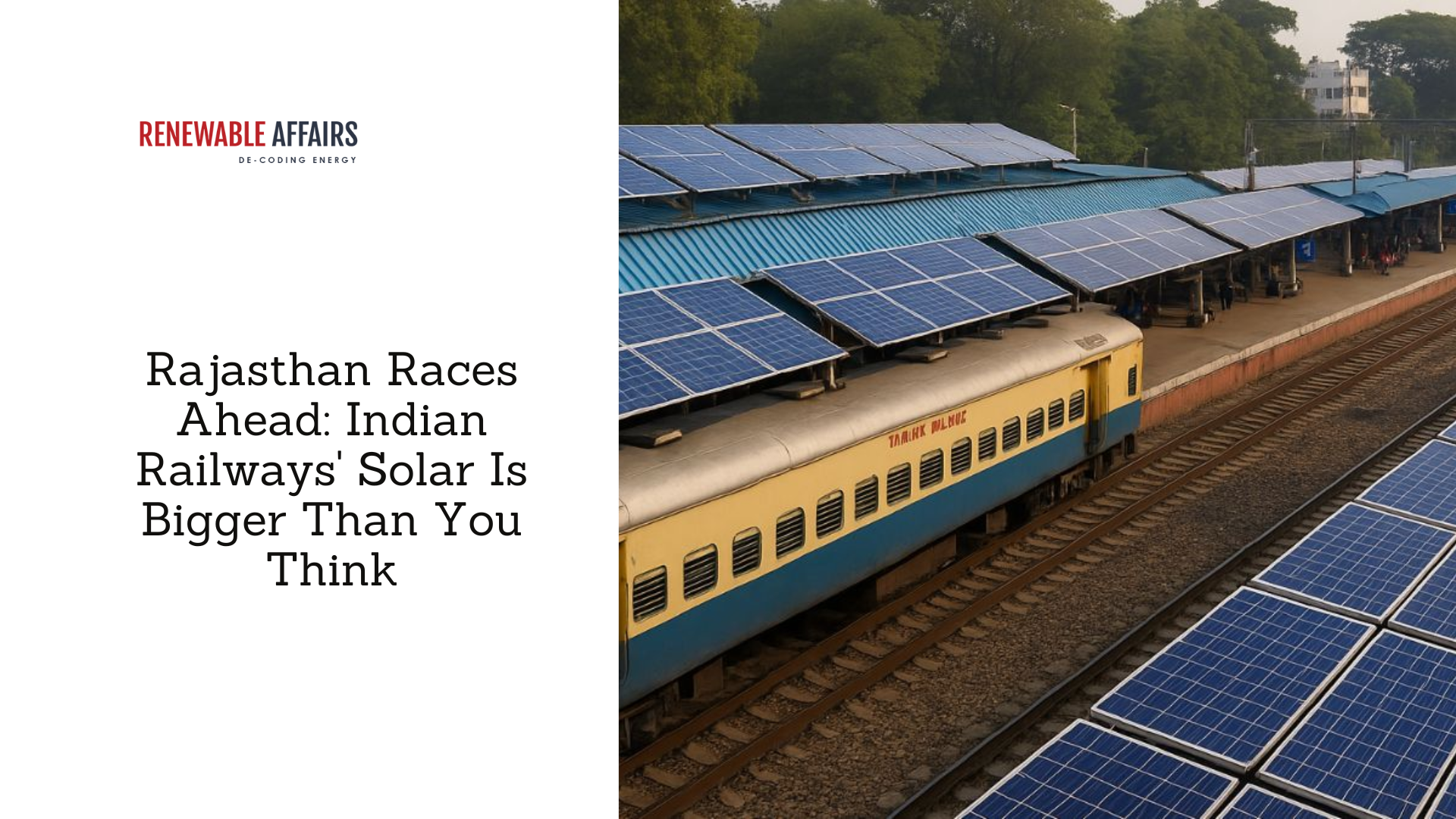

Rajasthan, Maharashtra, and Gujarat added the most solar capacity this quarter, contributing 38.2%, 20.2%, and 17.7% of installations. Together, the top ten states made up 99.3% of all large-scale solar additions in the country.

The government’s latest GST cut managed to lower costs on a few projects. Still, that kind of relief did not last long. Duties on solar cells and modules went up instead. It pretty much erased most of the original savings.

India’s solar capacity now stands at 125.5 GW as of September 2025. From that amount, 85.2 percent comes from large utility-scale projects. The other 14.8 percent is from rooftop setups.

Solar energy now makes up 25.1% of India’s total power capacity and 51% of all renewable energy capacity. Rajasthan, Gujarat, and Karnataka are still the top states with the highest installed large-scale solar capacity.

India’s future solar pipeline also looks strong. There are 191.9 GW of large-scale projects being developed, and another 162.5 GW have already been tendered and are waiting for auctions.

In Q3, the government announced 16.5 GW of new solar tenders. They also completed 2.2 GW of auctions.

But overall, in the first nine months of 2025, India issued only 37.5 GW of new tenders, which is a big 48% drop compared to the 72 GW announced in the same period in 2024.

At the same time, the average cost of building large solar projects fell slightly, about 1% lower than the previous quarter.

Source

0 Comments