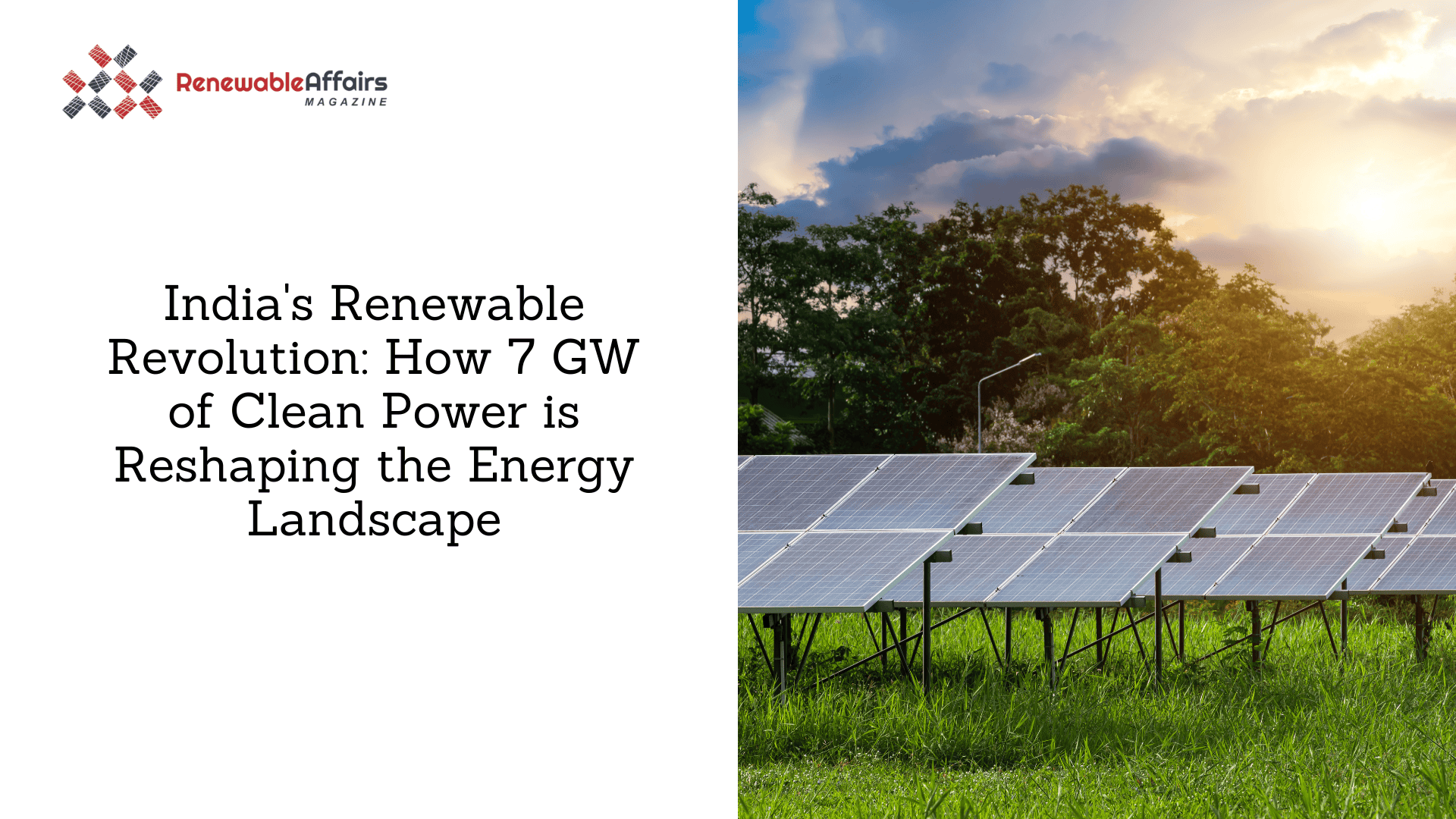

State-run NLC India has taken a major step towards strengthening its renewable energy business. The company’s board has given in-principle approval to list its wholly-owned subsidiary, NLC India Renewables Limited (NIRL).

As part of this plan, the government is expected to sell up to 25% stake in the renewable arm in one or more portions through a public offer, in line with the National Monetisation Pipeline.

Along with the listing decision, NLC India announced an interim dividend of ₹3.60 per share for the financial year 2025–26. Shareholders who hold the stock as of January 16, 2026, will be eligible to receive this dividend. The board also approved an investment of up to ₹66.60 crore in NLC India Renewables by buying equity shares. It is showing the company’s focus on growing its clean energy business.

When it comes to the stock market, NLC India has not performed very well in the short term. The stock has gained 6% in the last one year, while the Nifty index rose 10% during the same period. But, the long-term performance is strong. Over the last three years, the stock has jumped 215% and is currently trading above its key moving averages. This is seen as a positive sign.

NLC India is a Navratna public sector company under the Ministry of Coal. It is mainly involved in lignite mining and power generation, and at the same time, it is gradually expanding its presence in solar and wind energy.

Headquartered in Neyveli, Tamil Nadu, the company is expanding its solar and wind portfolio in line with India’s energy transition goals.

The company is yet to announce its December quarter results. In the September quarter, consolidated net profit fell 27% year-on-year to ₹665 crore, while total revenue stood at ₹4,347 crore, marginally lower than the same period last year.

Disclaimer: The information provided here is for general informational purposes only and should not be considered financial, investment, or trading advice. Stock prices and market data are subject to change without notice. Renewable Affairs does not guarantee the accuracy, completeness, or reliability of this information and assumes no responsibility for any investment decisions made based on it. Readers are advised to conduct their own research or consult a qualified financial advisor before making any buying or selling decisions.

Source

0 Comments