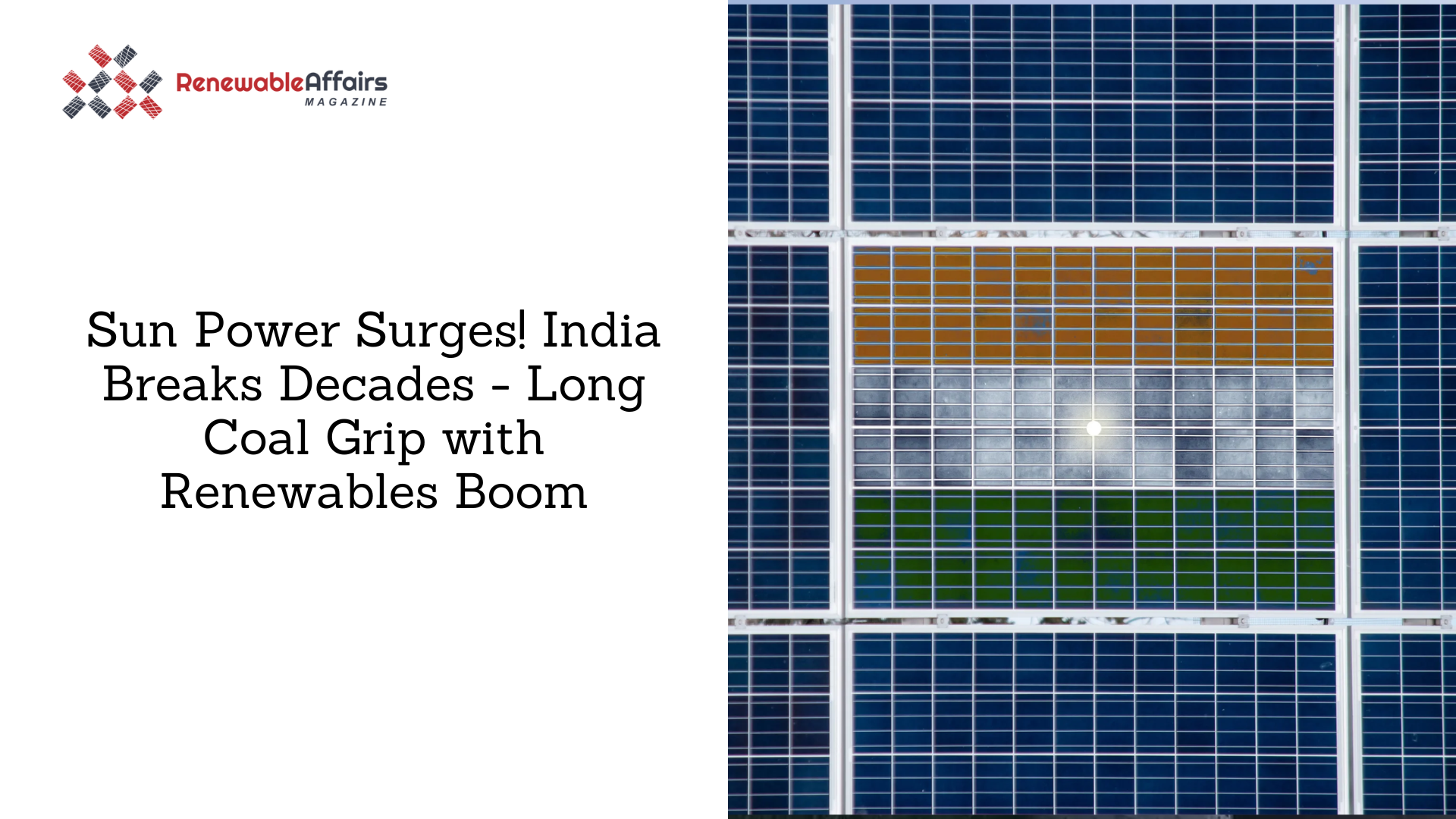

China’s biggest solar material makers are finally seeing a comeback after suffering heavy losses over the past two years.

Top polysilicon manufacturer Tongwei Co. reported a strong recovery in the July–September quarter, with its losses shrinking sharply to 315 million yuan ($44 million) from 844 million yuan a year ago. Similarly, GCL Technology Holdings Ltd., the second-largest producer, posted a 960 million yuan profit, compared to a 1.81 billion yuan loss last year.

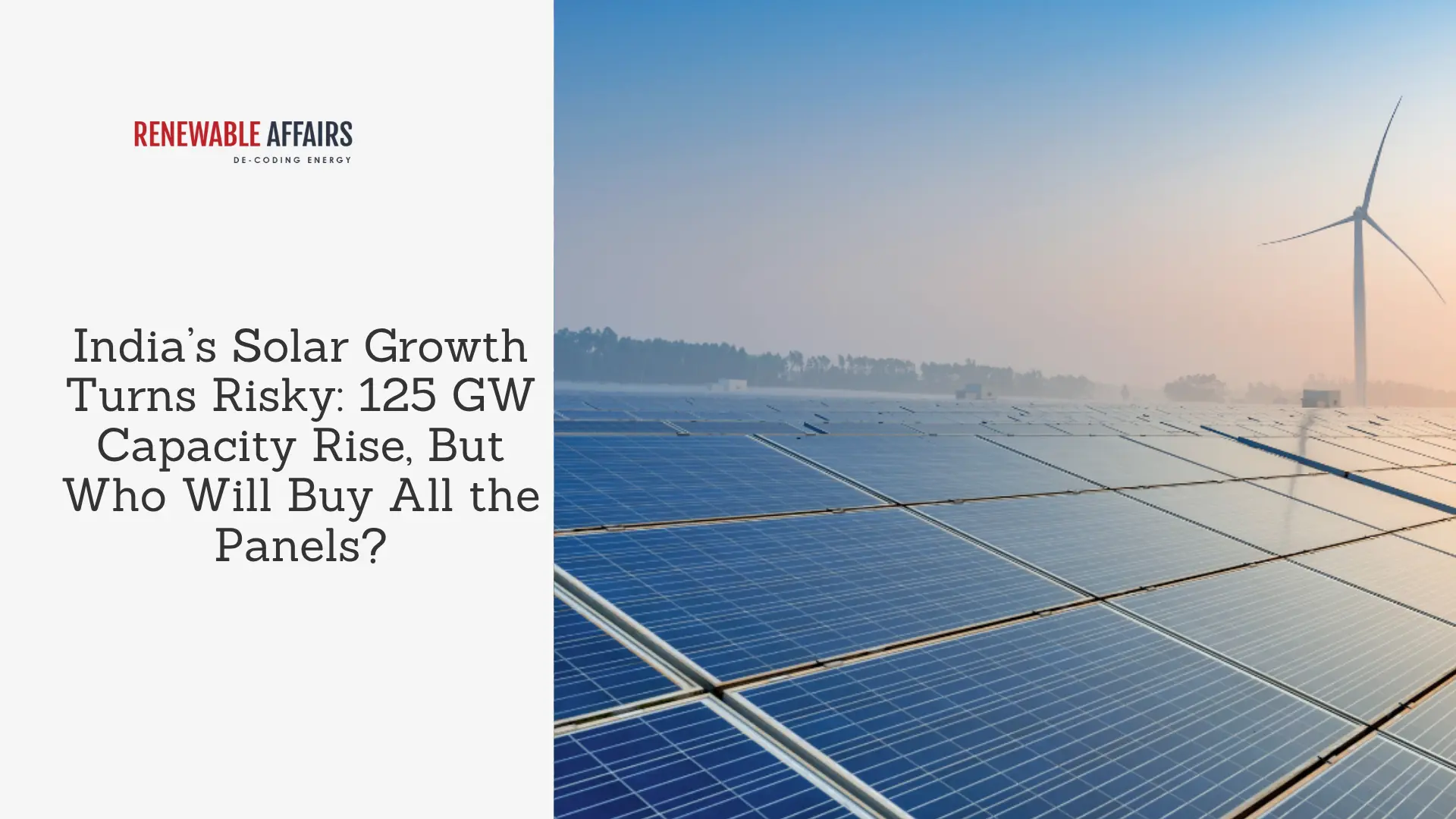

The main reason behind this turnaround is a 50% jump in polysilicon prices since July. The Chinese government had started warning companies against excessive competition, and the industry itself launched a 50-billion-yuan plan to cut down on extra production capacity.

According to Citigroup, GCL’s return to profit is a major milestone for the solar sector. The bank said the company’s strong results prove that recent “anti-involution” efforts, aimed at ending aggressive price wars, are working. Analysts expect profits to continue improving in the next quarter.

Another major player, Daqo New Energy Corp., is also expected to report better results soon. The company’s CFO recently said the market has “hit the bottom” and is now stabilizing.

While the government has mostly stayed out of direct intervention, companies like GCL are focusing on working together with suppliers and partners to create a more stable market.

However, challenges still remain. China’s solar installations are slowing down as clean power projects start competing directly with coal, and exports are facing global trade restrictions. Even so, Citigroup believes new government support measures could be coming soon.

Source

0 Comments