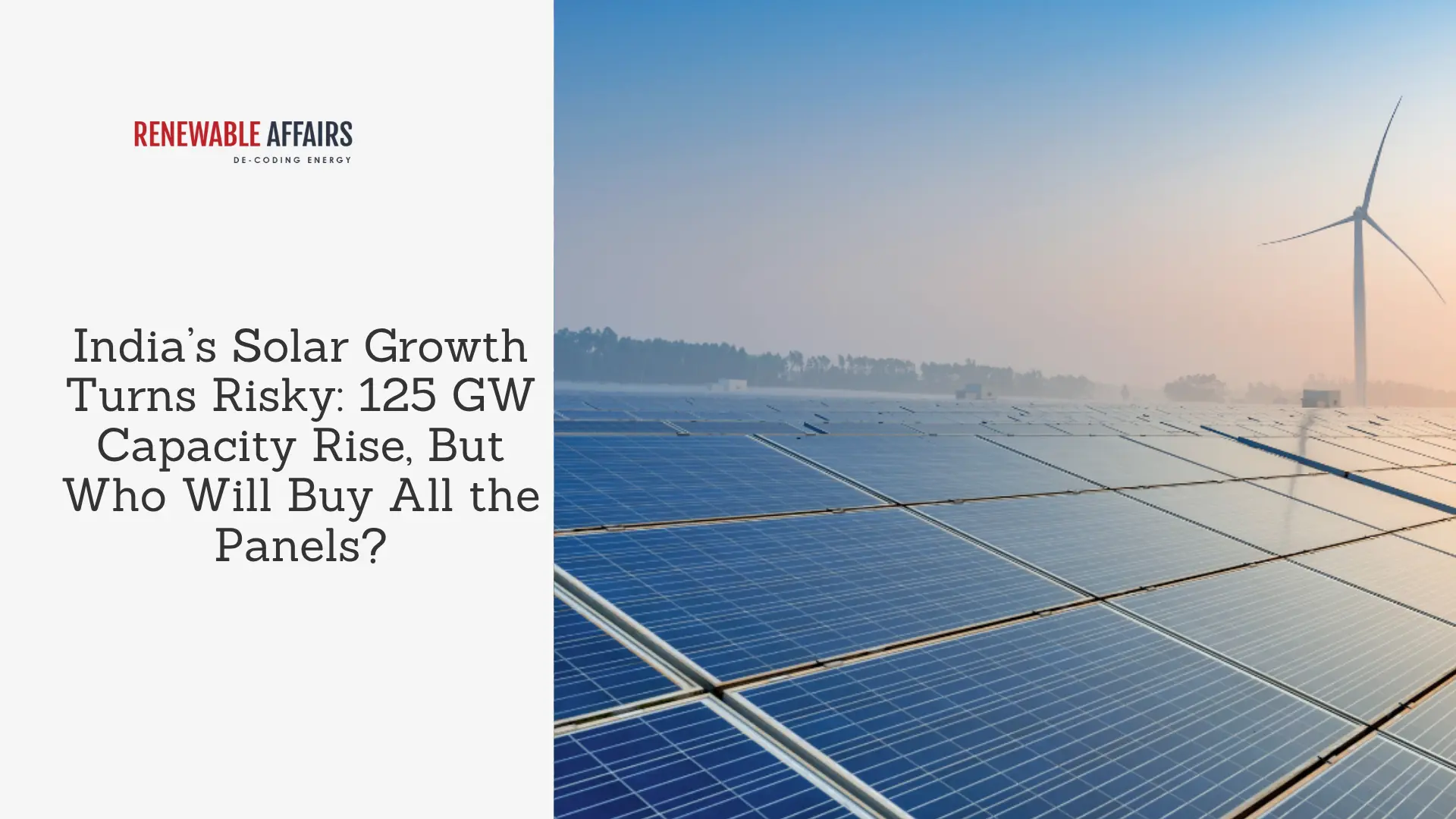

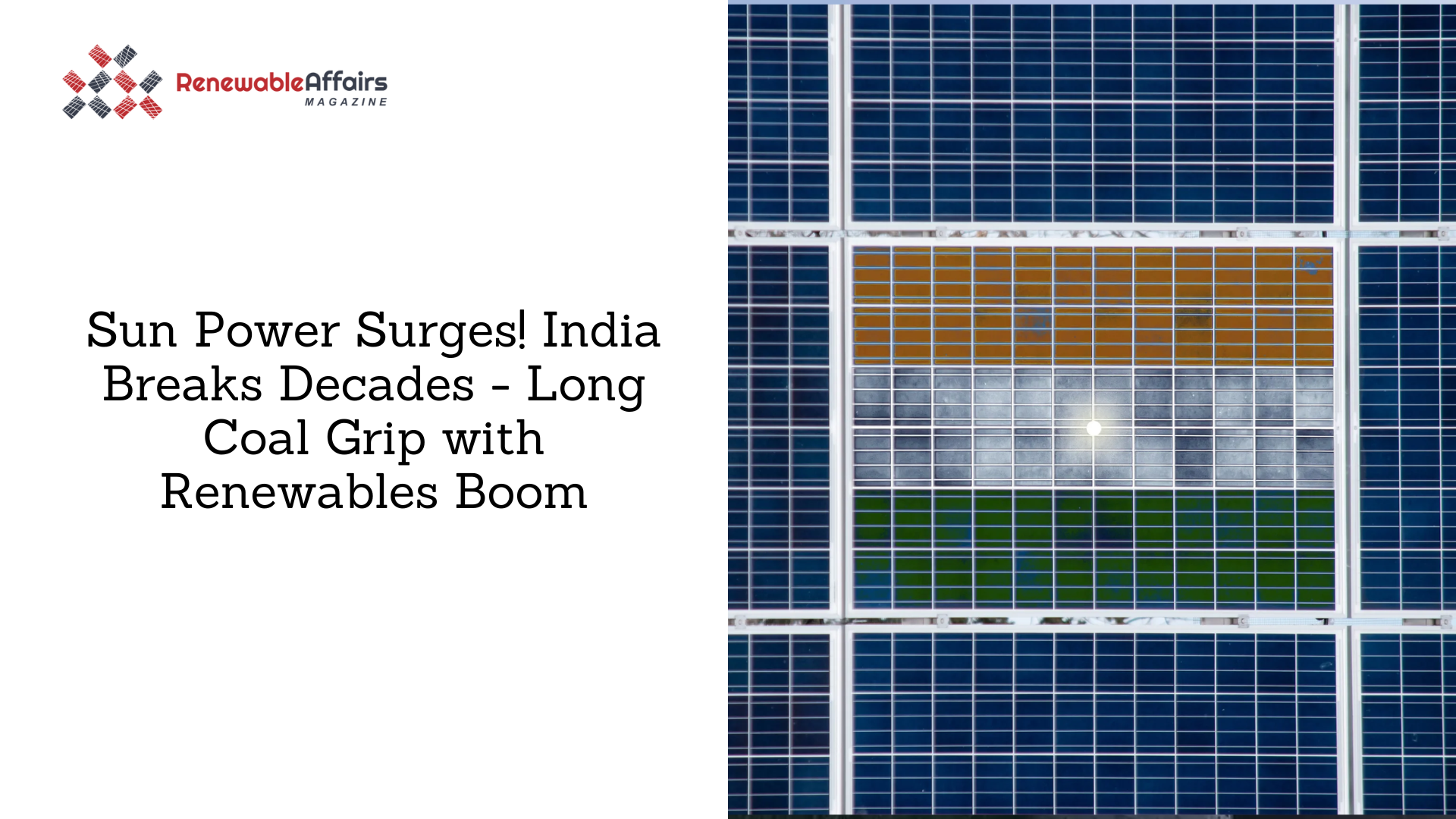

TheMinistry of New and Renewable Energy (MNRE) has advised NBFCs to temporarily halt lending to the renewable energy sector, due to serious overcapacity in the industry.

This move could slow down the flow of new funds into solar and wind projects, and many NBFCs may need to rethink how they manage their portfolios and risks.

NBFCs have been major supporters of renewable energy growth, so this recommendation comes as a surprising shift. If lending pauses, upcoming projects may find it harder to secure financing, which could eventually slow down the pace at which new renewable installations come up.

The ministry’s advice also brings attention to how fast the sector has expanded, and whether its growth is currently ahead of actual demand.

This situation raises important questions about how India can balance its clean energy plans with what the market can actually support. It also shows how much financial institutions influence the future of renewable energy.

As policies change, both NBFCs and renewable energy companies will need to stay prepared and adjust their strategies to keep up with the new direction.

Source

0 Comments