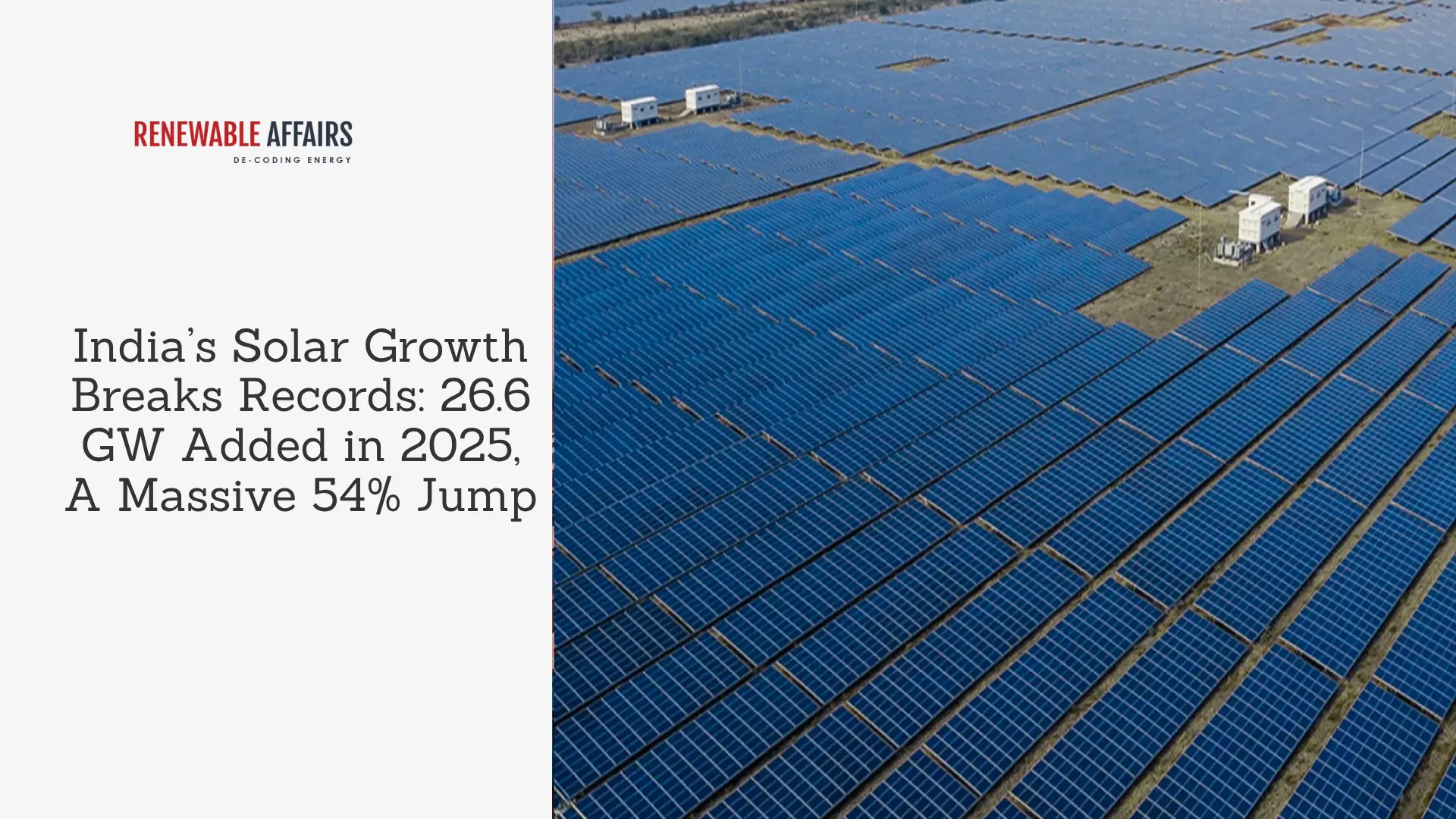

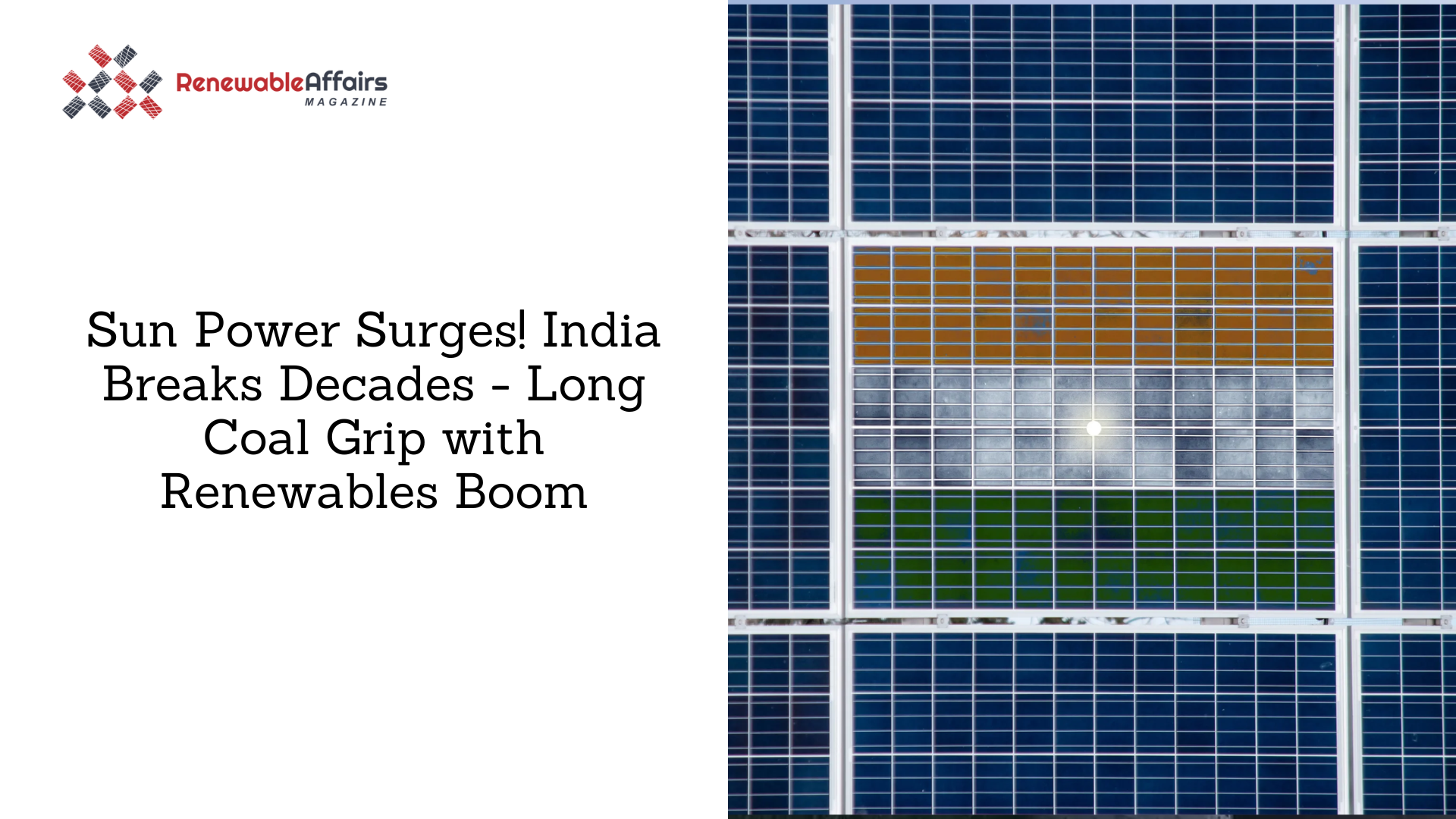

Waaree Energies, one of India’s leading solar cell and module manufacturers, has seen its share price rise more than 26% in the last six months. Now, brokerage firm Motilal Oswal has started coverage on the stock with a Buy recommendation. The firm has set a target price of ₹4,000 per share, which suggests the stock could rise up to 19% from current levels.

According to Motilal Oswal, Waaree Energies is expected to see steady growth because the demand for solar cells is increasing, while new supply capacity is taking time to catch up. This means Waaree is expected to maintain good pricing and profit margins until FY27.

The report also mentioned that Waaree is growing into new business areas like battery storage systems, EPC services, and green hydrogen. These new areas could contribute about 15% of the company’s earnings by FY28, which makes Waaree’s business stronger.

However, Motilal Oswal also noted that while profits should remain strong until the first half of FY28, there may be pressure on margins after that, as more companies add new solar manufacturing capacity and competition increases.

A supportive government policy environment is also working in Waaree’s favour. India has set a goal of installing 500 GW of renewable energy by 2030. To support this, the government is encouraging the use of solar panels and equipment made within the country.

Policies like the Approved List of Module Manufacturers (ALMM) and upcoming lists for cell and wafer makers are designed to support Indian companies. Because of this, companies like Waaree are expected to benefit.

Waaree Energies is also planning to increase its production capacity by the end of FY26–FY27, so it can meet the growing demand for solar products.

The company currently has an order book worth ₹47,000 crore, giving it strong revenue visibility for the next few years. The management expects its EBITDA to reach ₹5,500–6,000 crore in FY26. Motilal Oswal estimates that the company’s EBITDA could grow at 43% annually, and profit could grow at 40% annually between FY25 and FY28.

Overall, the brokerage believes Waaree Energies is well-positioned to benefit from India’s renewable energy growth, supportive policies, and its own expansion strategy.

Source

0 Comments